19 Oct Standby Letter of Credit Provider

Who is a Standby Letter of Credit Provider?

What is a Standby Letter of Credit (SBLC/SLOC)?

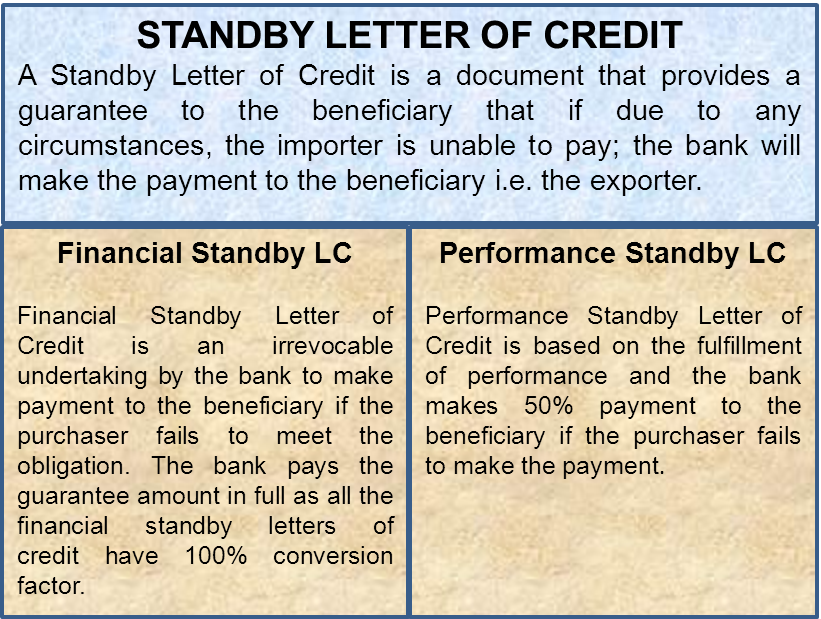

A standby letter of credit (SBLC/SLOC) is a guarantee of payment by a bank on behalf of their client. It is a loan of last resort in which the bank fulfills payment obligations by the end of the contract if their client cannot. A standby letter of credit can also be abbreviated SBLC or SLOC. A standby letter of credit is different from a Commercial Letters of Credit.

Differences Between Standby Letter of Credit and Commercial Letters of Credit

A letter of credit (LC), also known as a documentary credit or bankers commercial credit, or letter of undertaking (LoU), is a payment mechanism used in international trade to provide an economic guarantee from a creditworthy bank to an exporter of goods. Letters of credit are used extensively in the financing of international trade, where the reliability of contracting parties cannot be readily and easily determined. Its economic effect is to introduce a bank as an underwriter, where it assumes the counterparty risk of the buyer paying the seller for goods. The Standby Letter Of Credit (SBLC) is governed by a set of guidelines known as the Uniform Customs and Practice (UCP 600), which was first created in the 1930s by the International Chamber of Commerce (ICC).

So What Is The Key difference: The ‘Letter of Credit’ and the ‘Standby Letter of Credit’ are two legal bank documents that are used by international traders. Both these letters are used to ensure the financial safety between the supplier and their buyers. And, SBLC is a type of LC that is used when there is a contingent upon the performance of the buyer and this letter is available with the seller to prove the buyer’s non-performance during the sale.

top letters of credit providers, real SBLC Providers, genuine SBLC providers, lease sblc providers, lease bg sblc providers, bank instrument providers, Financial SBLC, Financial SBLC provider, Financial SBLC, SBLC discounting, SBLC Monetizers, HSBC LC and SLBC are the two financial instruments that are meant to safeguard the financial interests of the international traders i.e. buyers and sellers. It simply means that both these terms are widely useful while making transactions between the two trading parties. These help in giving financial security to both the parties. Also, these contracts are produced in good faith and in both the cases the fund gets mobilized.

During a transaction, the buyer wants an assurance of receiving his product or merchandise on time, and the seller wants his security of being paid on time at the completion of the job. Here, a letter of credit is issued, for it is an assurance or a type of guarantee that the seller will receive his correct payments in time by the clients. The LC solves both the issues by bringing in the buyer’s and seller’s banks into the transaction.

The issuing bank of the buyer, then, opens a LC in the favor of the seller and states that the seller will be paid and that he or she will not suffer any damages or losses because of the non-payment of the buyer. Though, the money transfer to the seller will only be initiated after all the conditions or documents of the contract are completed. However, the bank also safeguards the interest of the buyer by not paying the supplier until it receives a confirmation from the supplier that the goods have been shipped.

Based on this, there are two types of LCs being issued, they are:

Documentary Letter of Credit (DLC) and

StandBy Letter of Credit (SBLC)

Now, the DLC depends on the performance by the supplier, whereas SBLC depends on the non-performance or default on the part of the buyer.

The purpose of this letter is to establish a bank guarantee for the deal or transaction with a third party. For example, if an individual wishes to take a loan, but does not have a sufficient credit standing, the bank may then ask for a guarantee from another party (third party), and this is done in the form of a standby letter of credit that is issued by another bank. However, the said individual would then have to produce certain documents or evidence to support the non-performance of the buyer to obtain the payment through the SBLC.

The bank is obligated to make payment if the documents presented comply with the terms of contract. Though, the SBLC are considered very versatile and can be used with modifications to suit the interests and requirements of the buyers and sellers.

Standby Letter of Credit in foreign trade

Standby Letter of Credit Types:

Financial standby LOC: An exporter sells goods to a foreign buyer, who promises to pay within 60 days. If the payment never arrives (and the exporter requires the buyer to use a standby letter of credit) the exporter can collect payment from the importer’s bank. Before issuing the letter of credit, the bank typically evaluates the importer’s credit and determines that the importer will repay the bank. But if the customer’s credit is in question, banks may require collateral (or funds on deposit) for approval.

Performance standby LOC: A contractor agrees to complete a construction project within a certain timeframe. When the deadline arrives, the project is not complete. With a standby letter of credit in place, the contractor’s customer can demand payment from the contractor’s bank. That payment functions as a penalty to encourage on-time completion, funding to bring in another contractor to take over mid-project, or compensation for the headaches of dealing with problems. This is an example of a “performance” standby letter of credit, and a failure to perform triggers the payment.

Standby Letter of Credit Advantages:

An SBLC helps ensure that the buyer will receive the goods or service that’s outlined in the document. For example, if a contract calls for the construction of a building and the builder fails to deliver, the client presents the SLOC to the bank to be made whole. Another advantage when involved in global trade, a buyer has an increased certainty that the goods will be delivered from the seller.

Also, small businesses can have difficulty competing against bigger and better-known rivals. An SBLC can add credibility to its bid for a project and can oftentimes help avoid an upfront payment to the seller.

The SBLC / SLOC is often seen in contracts involving international trade, which tend to involve a large commitment of money and have added risks.

For the business that is presented with a SLOC/SBLC, the greatest advantage is the potential ease of getting out of that worst-case scenario. If an agreement calls for payment within 30 days of delivery and the payment is not made, the seller can present the SLOC to the buyer’s bank for payment. Thus, the seller is guaranteed to be paid. Another advantage for the seller is that the SBLC reduces the risk of the production order being changed or canceled by the buyer.

Standby Letter of Credit Uses:

A standby letter of credit helps facilitate international trade between companies that don’t know each other and have different laws and regulations. Although the buyer is certain to receive the goods and the seller certain to receive payment, a SLOC doesn’t guarantee the buyer will be happy with the goods. A standby letter of credit is most often sought by a business to help it obtain a contract. The contract is a “standby” agreement because the bank will have to pay only in a worst-case scenario. Although an sblc/sloc guarantees payment to a seller, the agreement must be followed exactly. For example, a delay in shipping or a misspelling a company’s name can lead to the bank refusing to make the payment. There are two main types of standby letters of credit:A financial sblc/sloc guarantees payment for goods or services as specified by an agreement. An oil refining company, for example, might arrange for such a letter to reassure a seller of crude oil that it can pay for a huge delivery of crude oil. Standby letters of credit can help establish trust with your business partners and be a powerful tool to help meet your business goals.

Follow this link to apply for a Standby Letter of Credit from prime banks

Standby Letter of Credit Cost

At Grand City Investment Limited, Standby Letter of Credit costs 4% of the SBLC amount per year and if the sblc is needed for more than one year, there will be an option of rolls and extensions where applicable. If the terms of the contract are fulfilled early, the customer can cancel the Standby Letter of Credit without incurring additional charges.

What is Standby Letter of Credit (SBLC) Monetization? How Do You Monetize SBLC??

SBLC Monetization or monetisation is the process of converting a standby letter of credit (sblc) into money or legal tender.

Grand City Investment Limited are sblc monetizers. We can arrange and assist clients to monetize their Standby Letter of Credit from rated banks. The Standby Letter of Credit Monetization arrangement issues Non Recourse funds to the Client shortly after the Standby Letter of Credit (SBLC) is delivered to the Monetizer.

Our SBLC monetization rate is 80% LTV which is the best rate in the industry, and above all, all our sblc are issued by top AAA rated banks such as HSBC Hong Kong, Citi Bank New York, Barclays Bank London, Credit Suisse etc.

Description of a Standby Letter of Credit For buy or Purchase:

1. Instrument: Standby Letter of Credit (SBLC), cash-backed,

2. Total Face Value: Eur/USD 2 Million (Min) to Eur/USD 5B (Max)

3. Issuing Bank: Citibank New York, HSBC Hong Kong, Barclays Bank London, Deutsch Bank Frankfurt or any AA Rated Bank.

4. Term / Age: One (1) Year and One (1) day, Fresh Cut

5. Invoice Price: 45% Net and 47% Gross of the face value of each BG/SBLC to the Seller, including 2% consultancy fees as per IMFPA.

6. Consultation Fee: In total of 2%, which is to be split and paid to the consultants as follows:

1% to …(Seller’s Mandate).., paid by the Seller/Payer-1

1% to ………………………, paid by the Buyer/Payer-2 7. Delivery of instrument: Bank-To-Bank by SWIFT MT-760, as per the Schedule of Delivery of Buy-Sell Agreement

8. Payment for instruments: By SWIFT MT-103 wire transfer

9. Original Hard Copy: By bonded courier to Buyer’s designated Depository Bank within Seven (7) bank working days after receipt of BG/SBLC(s) settlement payment by SWIFT MT-103 into the Seller’s account.

Description of a Standby Letter of Credit For lease or rent:

1. Instrument: Fully Cash Backed Standby Letter of Credit {SBLC}

2. Total Face Value: USD 2Million (Min) to USD 5B (Max)

3. Issuing Bank: HSBC Hong Kong, Barclays Bank London or any prime Bank.

4. Age: One Year and One Day (with rolls and extensions where applicable)

5. Leasing Price: 4% (+ 2% brokers commission where applicable) 2% broker commission applies to clients that were introduced by brokers

6. Delivery: SWIFT MT-760

7. Payment: MT103 Wire Transfer

8. Hard Copy: Bonded Courier within 7 banking days.9. Bank Transmission fee: Depends on the face value of the bank instrument

These are the top 7 reasons why many Standby Letter of Credit transactions fail.

1. Free Standby Letter of Credit Without Upfront Fees – Many people are under the false illusion that they can close a Standby Letter of Credit transaction free of charge without spending any money upfront. They want the Standby Letter of Credit provider to pay any upfront fees so that they can complete the sblc transaction for free of charge without spending anything. However, there is no such thing in the world as a free bg sblc, and every customer must have the capacity to pay any fees or costs associated with the bg sblc transaction, if you don’t pay this fee nobody will pay it for you. This is the number one reason why many SBLC transactions fail. If free bg sblc is possible I believe that everyone in the world will be a billionaire.

2. Customers Procedure: Every week we receive Standby Letter of Credit inquiries from people who say they want SBLC to be issued according to their own terms and conditions. Obviously this is not POSSIBLE; Banks and sblc providers do not work according to a customers terms. If you need SBLC or any financial instrument for that matter then you have to follow the bank or sblc providers laid down rules and procedures. This is the second reason why many sblc deals fail.

3. Cheap Price: Greedy people are easily lured by fake artificially low Standby Letter of Credit prices offered by scammers. The simple truth is, when a scammer is not delivering anything real they can afford to offer you the deal of the century. So when it sounds too good to be true then be careful. Price Shopping is the third reason why sblc transactions fail.

4. Greedy Million Billion Gang: Offers that set forth tranches of $5b, $20b and more, are just pure nonsense. Every week we receive offers from people who claim they need Billion Dollar SBLC or more. Truth is that most people who troll the internet with multi billion dollar SBLC requests do not have any money in their bank account to close the deal. Greed and Ignorance will make you lose your sense of reasoning. Many people don’t want to hear these things because truth hurts but we will keep saying the truth regardless.

5. Bank Endorsed Deed of Agreement (DOA): Banks do not endorse SBLC deed of agreement contracts or LOI. This action would place a financial liability on the bank and they cannot and will not incur that liability on behalf of their depositors. So if you received any offer or document from anyone claiming it has been endorsed by the bank kindly run for your life because it is FAKE.

6. BPU (Bank Payment Undertaken): Banks do not issue BPU to enable a customer to get a financial instrument without paying upfront fee. This is just joker-broker and uninformed customer nonsense. You don’t believe me? Well contact your banker and ask questions. I am a seasoned banker that has worked with some of the world’s biggest banks so I know.

7. ICBPO MYTH: ICBPO means Irrevocable Conditional Bank Pay Order. Banks do not issue irrevocable conditional bank purchase orders (ICBPO), or any purchase orders, period. Many joker brokers and uninformed clients think they can close a deal with ICBPO. In fact, a bank is precluded from incurring any liability on behalf of a depositor. And, the words “irrevocable conditional” form an oxymoron. No western world bank will issue a MT543, as it is a liability on behalf of the bank. In fact, as of September 1, 2003, the MT543 is gone from the banking world. This is just joker-broker and uninformed customer nonsense. You don’t believe me? Well contact your banker and ask questions.

Standby Letter of Credit Provider – Grand City Investment Limited

Standby Letter of Credit Process – How To obtain a Standby Letter of Credit (SBLC)

If you are in the market to obtain a standby letter of credit, then read this article about how to get genuine standby letter of credit from rated banks in France, Germany, Switzerland, USA, UK or Dubai.

Dear ladies and gentlemen,

We, the Ravens Power AG are pleased to submit this letter with the intent to declare our firm interest to lease a Standby letter of credit (SBLC), through Your sources, as follows:

I. The purpose of the SBLC. The SBLC will be used as a partial collateral for an already approved and signed line of credit. The credit line has a term of 15 years and the SBLC will be exchanged upon expiry – within 11 months, against mortgage for the Real Estate property, that will be acquired by our company, during the first year of the credit term.

II. Subject Stand by letter of credit in the amount of €100,000.000,00 ( Euros one hundred million ) for the term of one year and one day as per conditions stated below and provided SWIFT Verbiages –

2. TOTAL FACE VALUE: EURO 100,000,000.00 ( one hundred million Euro ) delivered in one tranche

3. RECEIVING BANK : Kantonalbank Switzerland

4. AGE: FRESH CUT

5. EXPIRY OF THE SBLC 1 year and 1 day

6. RETURN OF THE SBLC 21 days before Expiry

7. DELIVERY: BANK TO BANK SWIFT MT 199, MT799 AND MT760

8. PAYMENT: BPU/MT103

9. HARD COPY: BY BANK BONDED COURIER LATEST 5 DAYS AFTER DELIVERY OF MT760

10. PRICE: To be agreed in % of the Face Value

11. COMMISSION: To be agreed in % of the Face Value

12. VERBIAGES: Article IX of this Letter of Intent

III. Cost of the SBLC

IV. Proof of Funds to pay for the SBLC Funds are guaranteed by the Receiving bank via MT799. Please see the Verbiages – Article IX of this Letter of Intent . The text on the agreed Bank Verbiages may vary in substance, but the essential undertaking must be maintained.V. Payment for the SBLC

A. Within 7 ( seven) banking days after receipt and verification of the SBLC including Hard Copy, by our receiving Bank, provided that the fee of the SBLC will be 8% or lower . This buying price will be guaranteed via MT 799. ( see page 8 of this letter of Intent.)

B. Within 45 ( forty-five ) banking days after receipt and verification of the SBLC including Hard Copy, by our receiving Bank, provided that the fee of the SBLC will be 9% or higher. This buying price will be guaranteed via MT 799. ( see page 8 of this letter of Intent.)VI. Payment of the Commission To be agreed in percentage and time of deliveryVII. No Pre-payments Our credit line allows us to guarantee the Issuer the payment for the instrument directly by Bank Swift and therefore we will not deal with any speculative pre-payment dealers or intermediary that require payment before delivery of the Instrument.

VIII. Recommended procedure

a. Provider and Receiver will sign Deed of Agreement, attach CIS, Passport copy of the signatories,

which thereby becomes a full commercial contract with all attachments.

b. Provider ́s bank will issue MT199 with the Verbiage as per Annex A to the Receiver’ s Bank

Coordinates stated in this agreement, within 7 banking days after signing this Agreement. The

Provider will deliver a copy of the MT 199 SWIFT bank message to the Receiver ́s email address, listed

on first page of this DOA, within 1 banking day after issuance.

c. Within 3 banking days the Receiving bank will answer with MT 199, stating their readiness to

receive the BG/SBLC (Annex A1 ). The Receiver will deliver a copy of the MT 199 SWIFT answer from

the bank to the Provider ́s email address, listed on first page of this DOA, within 1 banking day after

issuance.

d. Provider ́s bank will issue MT799 with the Verbiage as per Annex B to the Receiver’s Bank

Coordinates within 3 banking days. The Provider will deliver a copy of the MT 799 SWIFT bank

message to the Receiver ́s email address, listed on first page of this DOA, within 1 banking day after

issuance.

e. Receiver’s bank will answer with MT799 with the Verbiage as per Annex B1 to the Provider’s Bank

Coordinates within 3 banking days, stating that they are ready to fulfill the complete agreement,

provide the credit line to the Receiver and guarantee the payment of the fees plus commissions after

receipt and verification of MT760 and Hard Copy delivered by Bank Bonded Courier. The Receiver will

deliver a copy of the MT 799 SWIFT answer from the bank to the Provider ́s email address, listed on

first page of this DOA, within 1 banking day after issuance.

f. Provider’ s bank issues MT 760 as per Verbiage Annex C and sends Hard Copy to the Receiver. The Provider will deliver a copy of the MT 760 SWIFT bank message to the Receiver ́s email address, listed on first page of this DOA, within 1 banking day after issuance.

g. Within 7 banking days after receipt and successful verification and acceptance of the MT760 the Receiver’s bank transfers the lease fee via MT 103 to the designated bank account of the Provider, specified in this agreement for fee below 8%. Within 45 banking days after receipt and successful

verification and acceptance of the MT760 the Receiver’s bank transfers the lease fee via MT 103 to the designated bank account of the Provider, specified in this agreement above 9%.

h. The SBLC will be returned officially by the Receiving Bank to the Issuing Bank 21 days before the expiry unencumbered and free of any charge or lien.

i. The transaction is completed.

IX. VerbiagesVerbiages Terminology:Issuing Bank – Refers to the Bank appointed by the Provider to Issue the BG/SBLC Beneficiary Bank –

Refers to the Bank appointed by the Receiver to accept BG/SBLC Account Number – Refers to Bank

Account Number in full form or IBAN Investment Agreement Transaction Code – Refers to

compulsory description of this transaction which is stated as following : BOC-DB-BZ-TK-500M0620VERBIAGE / ANNEX A

VERBIAGE MT199 RWA (required) FROM ISSUING BANK TO BENEFICIARY BANK (Text may vary in

substance, but the essential undertaking must be maintained)ATTENTION: MR ……….

ON BEHALF OF OUR CLIENT (NAME OF THE COMPANY ) …………………….. ACCOUNT NUMBER:

…………………………

INSTITUTION FOR THE FURTHER DELIVERY OF THE BANK GUARANTEE/STANDBY LETTER OF CREDIT

REFERENCE: ( NUMBER ) …………………………

MILLION EURO) IN FAVOUR OF YOUR CLIENT ACCOUNT : ( NAME OF THE COMPANY ) ……………………..

ACCOUNT NUMBER: ………………………. FOR A PERIOD OF ONE YEAR AND ONE DAY ASSIGNED FOR

THEIR FULL USE AND BENEFIT TO SECURE AND GUARANTEE ANY CREDIT OBLIGATIONS. UPON

RECEIPT OF YOUR RESPONSE WE WOULD RECIPROCATE BY OPENING THE BG/SBLC WITH YOUR GOOD

BANK.

FOR AND ON BEHALF OF …………………………

REGARDS,

BANK OFFICER: (1) TITLE PIN: BANK OFFICER: (2) TITLE PIN:

VERBIAGE / ANNEX A1

RESPONSE OF MT199 FROM BENEFICIARY BANK TO THE ISSUING BANK (Text may vary in substance,

but the essential undertaking must be maintained)

DEAR SIRS,

WE, …………. KANTONALBANK SWITZERLAND, WITH FULL BANKING RESPONSIBILITY AND LIABILITY

HEREBY CONFIRM ON BEHALF OF OUR CLIENT (NAME OF THE COMPANY) …………………………

WE ARE READY, WILLING AND ABLE TO RECEIVE A BANK GUARANTEE/STANDBY LETTER OF CREDIT

FROM YOUR GOOD BANK. PLEASE PROVIDE US THE PRE-ADVICE INCLUDING THE DRAFT OF THE

GUARANTEE TEXT.

FOR AND ON BEHALF OF …………………………

REGARDS, (ISSUING BANK AND ADDRESS).

BANK OFFICER: (1) TITLE PIN: BANK OFFICER: (2) TITLE PIN:

VERBIAGE / ANNEX B

VERBIAGE MT799 PRE-ADVICE FROM ISSUING BANK TO BENEFICIARY BANK (Text may vary in

substance, but the essential undertaking must be maintained (BG/SBLC VERBIAGE AS PROVIDED IS

MANDATORY)

ATTENTION: MR. …………,

WE (ISSUING BANK AND ADDRESS) …………………………

RESPONSIBILITY THAT WE ARE READY TO ISSUE AND DELIVER ONE (1) BANK GUARANTEE/STANDBY

LETTER OF CREDIT (BG/SBLC) ICC FORMAT ON BEHALF OF OUR CLIENT, ( NAME OF THE COMPANY )

…………………………

…………………………

HUNDRED MILLION ONLY) IN THE LAWFUL CURRENCY OF THE EUROPEAN UNION IN FAVOR OF

…………………………

…………………………

SWIFT MESSAGE IS VERIFIABLE ON NORMAL BANK – TO – BANK BASIS WITH FULL BANKING

RESPONSIBILITY, UPON RECEIPT OF CLEARANCE FROM OUR CLIENT. THERE WILL BE NO LIENS AND

ENCUMBRANCES ON THIS INSTRUMENT WHICH SHALL BE DELIVERED AND AVAILED VIA MT760 AND

EXACT BANK GUARANTEE/STANDBY LETTER OF CREDIT (BG/SBLC). THIS PRE-ADVICE IS VALID FOR

SEVEN (7) INTERNATIONAL BANKING DAYS ONLY AS AN OPERATIVE INSTRUMENT, NO MAIL

CONFIRMATION WILL FOLLOW. ALL CHARGES ARE FOR THE ACCOUNT OF RECEIVER.

FOR AND ON BEHALF OF……………………….

ADDRESS). BANK OFFICER: (1) TITLE PIN: BANK OFFICER: (2) TITLE PIN:

THE BG/SBLC FORMAT SWIFT MT760 AS FOLLOWS: FOR THE VALUE RECEIVED, WE, THE

UNDERSIGNED, (THE ISSUING BANK NAME) ………………………

(ADDRESS)…………………

IRREVOCABLE, UNCONDITIONAL, TRANSFERABLE, DIVISIBLE, AND WITHOUT PROTEST OR

NOTIFICATION, PROMISE TO PAY AGAINST THIS GUARANTEE NUMBER …………….. THE ORDER OF

(COMPANY NAME)…………………….

SUM OF EURO 100,000,000.00 (EURO ONE HUNDRED MILLION ONLY) IN THE LAWFUL CURRENCY OF

THE EUROPEAN UNION, UPON PRESENTATION AND SURRENDER OF THIS GUARANTEE AT ANY OF

THE COUNTERS OF OUR OFFICES AT (ADDRESS) …………………………

PAYMENT SHALL BE MADE WITHOUT SET-OFF AND FREE AND CLEAR OF ANY DEDUCTIONS,

CHARGES, FEES, OR WITHHOLDING OF ANY NATURE PRESENTLY OR IN THE FUTURE IMPOSED,

LEVIED, COLLECTED, WITHHELD OR ASSESSED.

THIS GUARANTEE IS CASH BACKED, DIVISIBLE, ASSIGNABLE AND TRANSFERABLE WITHOUT

PRESENTATION OF IT TO US AND MAY BE RELIED UPON FOR THE PURPOSES OF OBTAINING CREDIT

LINES OR LOANS. EXCEPT AS OTHERWISE EXPRESSLY STATED HEREIN, THIS GUARANTEE IS GOVERNED

AND CONSTRUCTED IN ACCORDANCE WITH THE LAWS OF (COUNTRY) ………………………. THIS

GUARANTEE IS GOVERNED BY THE UNIFORM RULES FOR DEMAND GUARANTEES AS SET FORTH BY

THE INTERNATIONAL CHAMBER OF COMMERCE LATEST REVISION OF PUBLICATION 500/600 URDG

758. YOUR DEMAND FOR PAYMENT SHOULD REACH US NOT BEFORE XX.XX.2021 <fourteen days

before expiry> BUT NOT LATER THAN XX.XX.2022 <one day after expiry> AFTER WHICH DATE, THIS

GUARANTEE EXPIRES IN FULL AND SHOULD BE CONSIDERED NULL AND VOID.

VERBIAGE / ANNEX B1

VERBIAGE MT799 FROM BENEFICIARY BANK TO THE ISSUING BANK

ACKNOWLEDGEMENT (DRAFT) BY SWIFT MT799 IN RESPONSE TO THE PRE – ADVICE SWIFT MT799

(Text may vary in substance, but the essential undertaking must be maintained)

DEAR SIRS, WE ……………….

AND LIABILITY HEREBY CONFIRM ON BEHALF OF OUR CLIENT ( NAME OF THE COMPANY)

…………………………

GUARANTEE/STANDBY LETTER OF CREDIT (BG/SBLC) NO. ……………………… DELIVERED BY SWIFT

MT760 AS ADVISED AND PER INVESTMENT AGREEMENT TRANSACTION CODE BOC-DBBZ-TK-

500M0620. WE FURTHER CONFIRM ON BEHALF OF OUR CLIENT ( NAME OF THE COMPANY)

…………………………

SHALL EXECUTE THE INVESTMENT AGREEMENT ON REQUEST OF OUR CLIENT ( NAME OF THE

COMPANY) …………………………

COMPLETE FEE TO BE PAID TO PROVIDER IN EUROS) AS DIRECT INVESTMENT IN FAVOR OF THE

ISSUING COMPANY( PROVIDER ́S CORPORATE NAME ) …………………………

NUMBER / IBAN …………………………

ADDRESS…………………..

FOR AND ON BEHALF OF (BENEFICIARY BANK AND ADDRESS)

BANK OFFICER: (1) TITLE PIN:

BANK OFFICER: (2) TITLE PIN:

VERBIAGE / ANNEX C

VERBIAGE OF THE “SWIFT MT760” FROM ISSUING BANK TO BENEFICIARY’S BANK (Text verbiage

must be maintained)

BANK GUARANTEE NUMBER : ……………………. BENEFICIARY ( NAME OF THE COMPANY)

…………………………

AMOUNT EURO ONE HUNDRED MILLION ONLY ISSUING DATE XX.XX.2020 MATURITY DATE ONE

YEAR + ONE DAY(FROM ISSUING DATE)

FOR THE VALUE RECEIVED, WE, THE UNDERSIGNED, (BANK NAME) …………………………

…………………………

TRANSFERABLE, DIVISIBLE, AND WITHOUT PROTEST OR NOTIFICATION, PROMISE TO PAY AGAINST

THIS BANK GUARANTEE NUMBER …………………………

…………………………

100,000,000.00 (EURO ONE HUNDRED MILLION ONLY) IN THE LAWFUL CURRENCY OF THE

EUROPEAN UNION, UPON PRESENTATION AND SURRENDER OF THIS BANK GUARANTEE AT ANY OF

THE COUNTERS OF OUR OFFICES AT (ADDRESS)…………………

BE MADE WITHOUT SET-OFF AND FREE AND CLEAR OF ANY DEDUCTIONS, CHARGES, FEES, OR

WITHHOLDING OF ANY NATURE PRESENTLY OR IN THE FUTURE IMPOSED, LEVIED, COLLECTED,

WITHHELD OR ASSESSED. THIS BANK GUARANTEE IS CASH BACKED, DIVISIBLE, ASSIGNABLE AND

TRANSFERABLE WITHOUT PRESENTATION OF IT TO US AND MAY BE RELIED UPON FOR THE

PURPOSES OF OBTAINING CREDIT LINES OR LOANS. EXCEPT AS OTHERWISE EXPRESSLY STATED

HEREIN, THIS BANK GUARANTEE IS GOVERNED AND CONSTRUCTED IN ACCORDANCE WITH THE

LAWS OF (COUNTRY)…………………

RULES FOR DEMAND GUARANTEES AS SET FORTH BY THE INTERNATIONAL CHAMBER OF COMMERCE

LATEST REVISION OF PUBLICATION 500/600 URDG 758. YOUR DEMAND FOR PAYMENT SHOULD

REACH US NOT BEFORE XX.XX.2021 <fourteen days before expiry> BUT NOT LATER THAN XX.XX.2021

<one day after expiry> AFTER WHICH DATE, THIS BANK GUARANTEE EXPIRES IN FULL AND SHOULD

BE CONSIDERED NULL ANDVOID.

FOR AND ON BEHALF OF (ISSUING BANK AND ADDRESS)

AUTHORIZED OFFICER AUTHORIZED OFFICER

(NAME, TITLE, PIN-CODE)

(NAME, TITLE, PIN-CODE)

X. Special condition

The SBLC will be returned 21 days before expiry date or renewed in mutual understanding at the

same conditions as agreed for the first issue.

XI. Further Cooperation

With our credit line, we are able to purchase total value of SBLCs in the amount of 500 million Eur . In

case if you would have one client that wishes to place larger amount with us, ( by lease or purchase )

we are able to purchase it in 3 tranches : 100 million, 200 Million and 200 Million. They can be

delivered in about 30 days after each other.

XII. General conditions

This letter of intent is not a binding contract. All details have to be negotiated and executed through

a final contract or other agreement. Your formal offer, in case You wish to enter in this transaction,

should be forwarded to us within 7 (seven) working days.

The following member of Ravens Power AG can be contacted for any additional information or in

on behalf of the Ravens Power AG

Sincerely,

Gabriela Weiss

Friedrich A. Breiteneder

Date: 20th of October 2020

No Comments