26 Aug Differences Between SBLC and Commercial Letters of Credit

What are the Differences Between Standby Letters of Credit and Commercial Letters of Credit?

Standby letters of credit and commercial letters of credit are two main documentary credit types used in international trade transactions.

A standby letter of credit is a bank’s undertaking of fulfilling the applicant’s obligations.

In case, the applicant can’t fulfill contractual obligations against the beneficiary of the standby letter of credit, then the beneficiary can apply to the issuing bank for full compensation.

A commercial letter of credit means any arrangement, however named or described, that is irrevocable and thereby constitutes a definite undertaking of the issuing bank to honour a complying presentation.

Commercial letters of credit are mainly used as a primary payment method in export and import of the tangible goods in international trade.

Click Here To Contact Standby Letters of Credit Providers

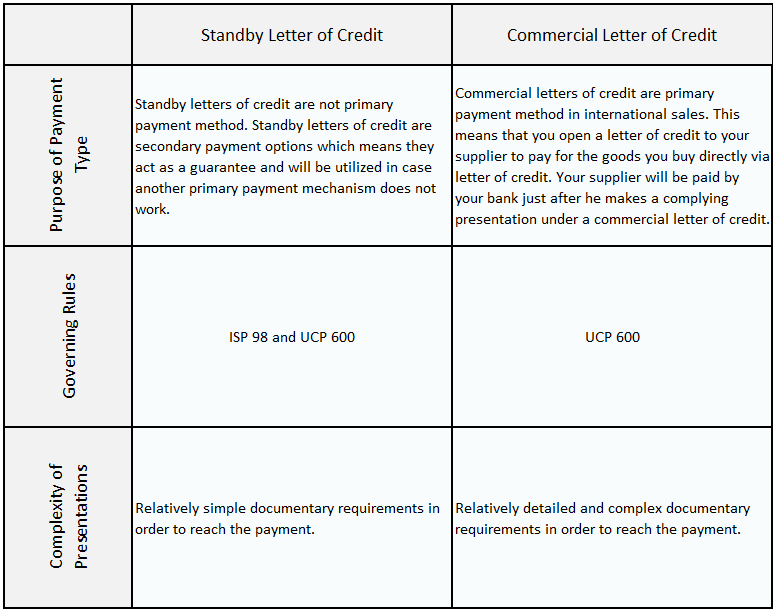

Table 1: Differences Between Standby Letter of Credit and Commercial Letter of Credit

Differences between standby letter of credit and commercial letter of credit – Grand City Investment Limited

Common Characteristics of Standby Letters of Credit and Commercial Letters of Credit:

Both standby and commercial letters of credit;

- are irrevocable and conditional payment promises, which is given by a trusted financial institution mostly by a bank.

- independent payment mechanisms, whatever contracts they may base.

- are governed by ICC’s rules, ISP 98 and UCP 600, respectively.

- have a documentary nature.

ISP 98 – International Standby Practices

ISP 98 is the set of rules that governs standby letters of credit. They have been published by ICC Banking Commission. ISP 98 – International Standby Practices ICC Publication No. 590 , 1998 Edition. ISP 98 is in force as of January 1, 1999

ISP 98 – International Standby Practices is the title of the book that is published by ICC to govern the standby letters of credit transactions (SBLC ).

ISP 98 consists of 76 pages in total. Full details of ISP 98 for ordering considerations are as follows : ISP 98 – International Standby Practices ICC Publication No. 590 , 1998 Edition. ISP 98 is in force as of January 1, 1999.

How to Buy ISP 98?

ISP 98 is both available by e-book format and hard copy. It is sold under online ICC Bookstores. You can buy ISP 98 from this link.

Benefit of ISP 98 – International Standby Practices

ISP 98 International Standby Practices was written exclusively for standby letters of credit.

Prior to ISP 98 standby letters of credit were issued under commercial letters of credit rules. This was not an effective way as standby letters of credit and commercial letters of credit have significant differences with regards to scope and practice.

ISP 98 has been reduced the cost and time of drafting, limit problems in handling and avoid countless disputes and unnecessary litigation that have resulted from the absence of internationally agreed rules on standby letters of credit.

International Standby Practices fills an important gap in the market place.

The 98 Rules in International Standby Practices (ISP98) offer a precise and detailed framework for practitioners dealing with standby letters of credit.

Developed by the Institute of International Banking Law and Practice, endorsed and published by the International Chamber of Commerce (ICC), ISP98 is the standardized text for the use of standbys worldwide.

ISP98 Rules

- contain precise definitions of key terms such as “original” and “automatic amendment”

- cover in detail the standby process from “Obligations” to “Syndication”

- provide neutral rules acceptable in most situations

- save both time and money in negotiating and drafting standby terms

- help avoid litigation and unexpected loss

- propose basic definitions should the standby involve presentation of documents by electronic means

- provide international standards for the use of this fast growing financial instrument

Table of Contents

- Rule 1 General Provisions

- Rule 2 Obligations

- Rule 3 Presentations

- Rule 4 Examination

- Rule 5 Notice, Preclusion, and Disposition of Documents

- Rule 6 Transfer, Assignment, and Transfer by Operation of Law

- Rule 7 Cancellation

- Rule 8 Reimbursement Obligations

- Rule 9 Timing

- Rule 10 Syndication/Participation

No Comments