30 Sep Bank Guarantee (BG) Meaning, Uses and Types

Bank Guarantee Meaning, Types, Uses, Advantages, Charges, Difference & Process.

What is the Meaning of Bank Guarantee?

A bank guarantee refers to a promise provided by a bank or any other financial institution that if a certain borrower fails to pay a loan, then the bank or the financial institution will take care of the losses.

The bank guarantee signifies a lending institution ensures that the liabilities of a debtor is going to be met. In other words, if the debtor is unsuccessful to settle a debt, the bank will cover it. A bank guarantee allows the customer, or debtor, to acquire goods, purchase equipment or draw down a loan.

A bank guarantee acts similarly to a line of credit, except that a line of credit can be drawn upon at will by the bank’s client. A bank guarantee is used only if the client does not pay its vendor an agreed-upon amount. U.S. credit institutions are forbidden from assuming guarantee obligations, and therefore most international transactions require a standby letter of credit.

Bank Guarantee Meaning – Grand City Investment Ltd

Types and Examples of Bank Guarantees

There are many different kinds of Bank Guarantee namely:

- A Payment Guarantee assures a seller the purchase price is paid on a set date.

- An Advance Payment Guarantee acts as collateral for reimbursing advance payment from the buyer if the seller does not supply the specified goods per the contract.

- A Performance Bond serves as collateral for the buyer’s costs incurred if services or goods are not provided as agreed in the contract.

- A credit security bond serves as collateral for repaying a loan.

For example, St. Marys hospital is a new hospital that wants to buy $1 million in medical equipment. The equipment vendor requires St. Marys hospital to provide a bank guarantee to cover payments before they ship the equipment to St. Marys hospital. St. Marys hospital requests a guarantee from the lending institution such as Grand City Investment Limited ( https://grandcityinvestment.com ) keeping its cash accounts. Grand City Investment Limited essentially cosigns the purchase contract with the vendor.

KEY TAKEAWAYS

- A bank guarantee is when a lending institution promises to cover a loss if a borrower defaults on a loan, of which there are many examples.

- Individuals often choose direct guarantees for international and cross-border transactions.

- A bank guarantee enables the customer, or debtor, to acquire goods, buy equipment or draw down a loan.

Uses of Bank Guarantee?

- When large companies purchases from small vendors, they generally require the vendors to provide guarantee certificate from banks before providing such business opportunities.

- Predominantly used in the purchase and sale of goods on credit basis, where the seller is assured of payment from the bank in case of default by the buyer.

- Helps in certifying the credibility of individuals, which in turn, enables them in obtaining loans and also assists in business activities.

Though there are lots of uses from a bank guarantee for the applicant, the bank should process the same only after ensuring the financial stability of the applicant/business. The risk involved in providing such a guarantee must be analysed thoroughly by the bank

Advantages and Disadvantages of Bank Guarantees?

Bank guarantee has its own advantages and disadvantages. The advantages are:

§ Bank guarantee reduces the financial risk involved in the business transaction.

§ Due to low risk, it encourages the seller/beneficiaries to expand their business on a credit basis.

§ Banks generally charge low fees for guarantees, which is beneficial to even small-scale business.

§ When banks analyse and certify the financial stability of the business, its credibility increases and this, in turn, increase business opportunities.

§ Mostly, the guarantee requires fewer documents and is processed quickly by the banks (if all the documents are submitted).

On the flip side, there are some disadvantages such as:

§ Sometimes, the banks are so rigid in assessing the financial position of the business. This makes the process complicated and time-consuming.

§ With the strict assessment of banks, it is very difficult to obtain a bank guarantee by loss-making entities.

§ For certain guarantees involving high-value or high-risk transactions, banks will require collateral security to process the guarantee.

Costs and Charges of Bank Guarantee?

Generally, Bank Guarantee charges are based on the risk assumed by the bank in each transaction. For example, a financial BG is considered to assume more risk than a performance BG. Hence, the fee for financial BG will be higher than the fee charged for performance BG.

Based on the type of the BG, fees are generally charged on a quarterly basis on the BG value of 0.75% or 0.50% during the BG validity period. Apart from this, the bank may also charge the application processing fee, documentation fee, and handling fee.

In some cases, security is required by the bank from its applicant, which is generally 100% of the BG value. In certain cases, collateral security or cash margin may also be accepted by the issuing bank. bank guarantee process,

Difference between Bank Guarantee (BG) & Letter of Credit (LOC)

Bank Guarantee is not the same as a letter of credit, although with both instruments the issuing bank accepts a customer’s liability if the customer defaults. With a guarantee, the seller’s claim goes first to the buyer, and if the buyer defaults, then the claim goes to the bank. With letters of credit, the seller’s claim goes first to the bank, not the buyer. Although the seller will likely get paid in both cases, letters of credit offer more assurance to sellers than guarantees generally do.

LOC is a financial document which imposes an obligation on the bank to make payment to the beneficiary on completion of certain services as required by the applicant. LOC is issued by the bank when the buyer requests his bank to make payment to the seller on the receipt of certain goods or services.

That is, when the buyer runs into cash flow difficulties or similar situations and thus cannot make immediate payment to the seller, he will approach his bank to make the payment to the seller on submission of certain documents. The bank will later recover the amount paid from the buyer along with the required charges.

On the other hand, under BG, the bank is required to make payment to the third-party only if the applicant fails to make the payment to the third-party or does not fulfil the required obligations under the contract. A BG is essentially used to ensure a seller from loss or damage due to the non-performance by the other party in a contract.

However, there are a lot of differences between LOC and BG.

Major differences between Letter of Credit (LOC) and Bank Guarantee (BG)

Particulars

LOC

BG

Nature

LOC is an obligation accepted by a bank to make payment to a beneficiary if certain services are performed.

BG is an assurance given by the bank to the beneficiary to make the specified payment in case of default by the applicant.

Primary liability: Bank retains the primary liability to make the payment and later collects the same from the customer.

The bank assumes to make the payment only when the customer defaults to make payment.

Payment: Bank makes the payment to the beneficiary as and when it is due. It need not wait for a default to be made by the customer.

Only when the customer defaults the payment to the beneficiary, the bank makes the payment.

Way of working: LOC ensures that the amount will be paid as long as the services are performed as per the agreed terms.

BG assures to compensate for the loss if the applicant does not satisfy the specified conditions.

Number of parties involved: There are multiple parties involved here — LOC Issuing bank, its customer, the beneficiary (third party), and advising bank.

There are only three parties involved — banker, its customer, and the beneficiary (third party).

Suitability: Generally, this is more appropriate during the import and export of goods and services. Suits any business or personal transactions.

Risk: Bank assumes more risk than the customer. Customer assumes the primary risk.

Process to obtain or acquire a bank Guarantee (BG)?

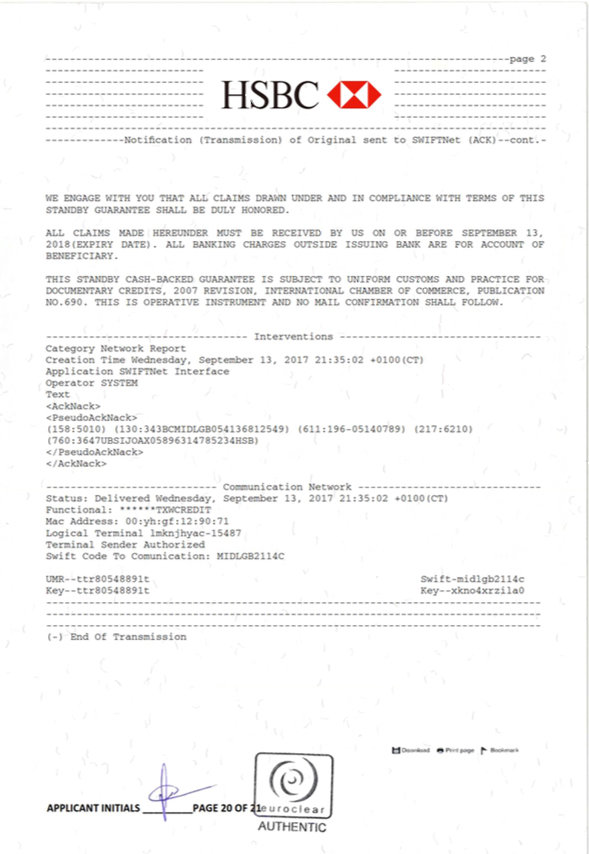

One of the simplest ways to obtain a Bank Guarantee (BG) is through Grand City Investment Limited. Established in Hong Kong on May 29, 1984, with CR No. 0137353, we are specialists in bank guarantees and take pride in being a leading provider of various financial instruments, including:

- Bank Guarantees (BG)

- Standby Letter of Credit (SBLC)

- Proof of Funds (POF)

- Business Credit Lines

- Performance Bond Guarantees

- Tender Bond Guarantees

- Advance Payment Guarantees

- Bank Comfort Letters (BCL)

Our financial instruments, including BGs and SBLCs, are issued from reputable banks such as Barclays, Standard Chartered, and HSBC, or any AAA-rated bank you prefer. All our financial instruments are cash-backed and can be utilized as collateral to secure funding for projects, as well as for discounting, monetization, and Private Placement Programs (PPP).

DIFFERENCES BETWEEN SWIFT MT799 AND SWIFT MT799 vs MT760 - Grand City Investment Ltd

Posted at 04:53h, 03 October[…] and MT799 are often mentioned when working with Bank Guarantees or types of Documentary […]

Bank Instruments Definition, Types, Uses - Grand City Investment Ltd

Posted at 07:05h, 03 October[…] Bank Guarantees: A bank guarantee is a promise by a lending institution to cover a loss if a business transaction doesn’t unfold as planned. The buyer receives compensation if a party doesn’t deliver goods or services as agreed or fulfill contractual obligations. […]

The importance of bank guarantees in modern business - Grand City Investment Ltd

Posted at 14:34h, 04 October[…] bank guarantee is an assurance from a bank promising to meet their debtor’s financial obligations if he […]

BG e SBLC: Soluções Financeiras Confiáveis para Negócios Internacionais - Grand City Investment Ltd

Posted at 11:35h, 18 November[…] enfrentam dificuldades em encontrar fornecedores genuínos de instrumentos bancários, como BGs (Garantias Bancárias) e SBLCs (Cartas de Crédito Standby). A indústria de instrumentos financeiros está cheia de […]