23 Sep Documentary Letters of Credit (DLC) Meaning (2024)

Introduction to Documentary Letters of Credit

A Documentary Letter of Credit (DLC) is a crucial financial instrument used in international trade to guarantee payment between buyers and sellers. This article will delve into the details of a DLC, including its various uses and benefits, as well as the process for obtaining one.

A Documentary Letter of Credit (DLC), also known as a Sight Letter of Credit, is a key financial tool issued by banks via a SWIFT MT700 message. It ensures that sellers or exporters receive payment from buyers or importers once all specified terms in the DLC are met. This instrument provides security and confidence in international trade transactions.

A documentary letter of credit is an undertaking of the bank, which has opened a letter of credit on request of a buyer (applicant) to pay an amount to the seller (beneficiary) as specified in the letter of credit upon the provision of documents by the seller (beneficiary) that meet the conditions of the letter of credit and confirm the shipment of commodities (the provision of services) within the prescribed time frame.

The Purpose of a DLC

The primary purpose of a DLC is to provide financial security to both parties involved in a transaction, particularly when they have not yet established a close business relationship or are located in different countries. By utilizing a DLC, sellers can mitigate risks associated with international legal systems and lack of trust with buyers.

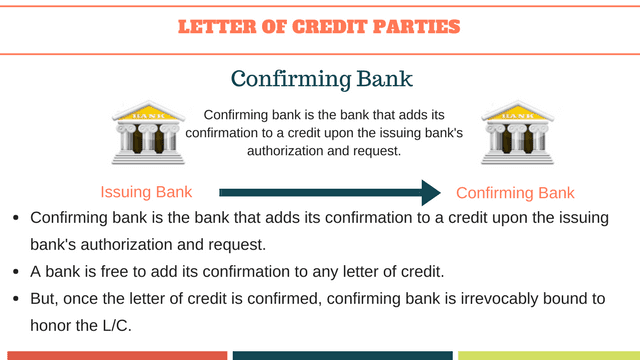

Parties Involved

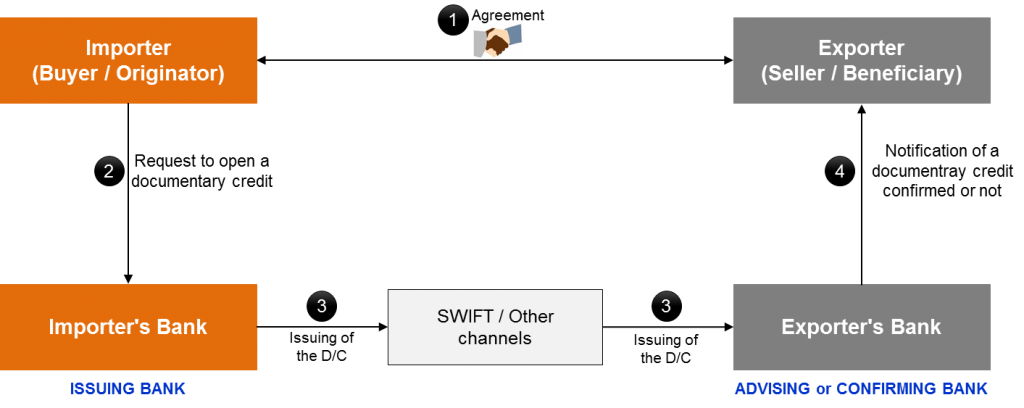

The parties involved in issuing a Documentary Letter of Credit are:

- Seller/Exporter (Beneficiary)

- Issuing Bank or Financial Institution

- Buyer/Importer (Applicant), who is also a customer of the bank or financial institution

- Advising Bank, of which the seller/exporter (beneficiary) is a client

Key Features of a DLC

Documents Required

A Documentary Letter of Credit requires the seller/exporter (beneficiary) to present specific documents before the expiration of the letter of credit. These documents directly relate to the contract between the seller/exporter and the buyer/importer, as they demonstrate to the issuer that the seller/exporter has fully fulfilled their part of the deal.

Conforming Presentation and Payment

Once the seller/exporter makes a conforming presentation, the issuing bank or financial institution will make a payment to the seller/exporter, even if the buyer/importer does not want to pay.

TYPES OF LETTERS CREDIT

There can be numerous types of letters of credit. Each may or may not be funded. Some of the most common types of letters of credit include the following:

- Documentary letter of credit

- Standby letter of credit

- Secured letter of credit

- Revocable letter of credit

- Irrevocable letter of credit

- Revolving letter of credit

- Red clause letter of credit

- Green clause letter of credit

Revocable Letters of Credit, which can be changed or canceled by the issuing bank without prior notice to the recipient of funds. Revoking of letter of credit does not create any obligation of the issuing bank to the payee. The nominated bank is obligated to make a payment or other operations on a revocable letter of credit if at the time of their commission they have not received notice of the change of conditions or canceling credit. A letter of credit is revocable if its text does not explicitly state otherwise.

Irrevocable letter of credit is a firm obligation of the issuing bank to pay money in order and the terms defined by the conditions of the letter of credit, if the documents provided for by it, submitted to the bank specified in the credit. Irrevocable letter of credit guarantees that the exporter will make payment to the performance of its obligations, even if an importer wants to abandon the deal. Therefore, the exporter, performing a special order, for which will not be another buyer, chooses exactly this kind of letter of credit.

Irrevocable unconfirmed letter of credit. When making an unconfirmed letter of the credit-issuing bank, providing a letter of credit, is the only party that is responsible for the disbursement to the seller. The nominated bank must pay only after receiving the money from the issuing bank. A nominated bank simply acts on behalf of the bank providing credit, so it does not take any risk.

Irrevocable confirmed letter of credit – the obligation of the issuing bank is confirmed by another bank. Confirmation is an additional guarantee of payment from another bank (Bank of the exporter or prime bank). Bank, confirming letter of credit is committed to paying for documents according to the conditions of the letter of credit if the issuing bank fails to make the payment.

Back-to-back letters of credit consist of two letters of credit (LoCs) used together to finance a transaction. A back-to-back letter of credit is usually used in a transaction involving an intermediary between the buyer and seller, such as a broker, or when a seller must purchase the goods, it will sell from a supplier as part of the sale to his buyer.

Governing Guidelines

The Documentary Letter of Credit is governed by a set of guidelines known as the Uniform Customs and Practice (UCP 600), created by the International Chamber of Commerce (ICC) in the 1930s.

Currently, LC issuance is governed by the latest version of UCP 600.

Letters of credit are used:

- if you are not certain about the solvency of your counterparty;

- if the counterparty is not certain about the proper performance of obligations by you (in terms of the quantity and quality of commodities or services);

- if you need a payment respite or trade credit;

- if you need a downpayment (advance payment) for the valuables to be supplied;

- if the counterparty insists on a settlement through letters of credit.

Advantages of Letters of Credit For The Seller:

- elimination of the credit risk, the receipt of an undertaking from a bank (banks) to pay for commodities supplied or services provided , if the seller lacks adequate information about the financial standing of the buyer or the credit relationship;

- elimination of the risk of receipt of a counterfeit undertaking or an undertaking issued by a non-existing bank;

- elimination of the risk of non-payment / late payment / partial payment for goods supplied / services provided;

- maximum reduction in the time interval between the shipment of the commodity (the provision of services) and the receipt of proceeds;

- elimination of the risk of order abandonment (change in conditions) by the buyer without the consent (permission) of the seller;

- possibility to get short-term funding;

- possibility to increase supply volumes, to promote commodities (services) in new markets, to gain competitive advantages.

Advantages of Letters of Credit For The Buyer:

- a letter of credit can be opened at the buyer’s own expense or using a bank loan by pledging other collateral to secure performance of its obligations (a lien on assets or a deposit, etc.);

- the buyer may withhold payment pending documentary confirmation that the goods meet the quality requirements and have been delivered in full to their specified destination (the payment is made after the goods are have been delivered and documents provided);

- the buyer specifies a list of documents against which payment will be made;

- the buyer limits the time frames for the provision of documents and goods delivery.

Disadvantages of a letter of credit:

- Usually covers single transactions for a single buyer, meaning you need a different letter of credit for each transaction.

- Expensive, tedious and time consuming in terms of absolute cost, working capital, and credit line usage.

- Additional need for security and collateral to satisfy bank’s coverage terms for the buyer.

- Lengthy and laborious claims process involving more paperwork for the seller.

International Trade

Letters of credit are used in international trade to mitigate risk. Importers and exporters regularly use letters of credit to protect themselves. Working with an overseas buyer can be risky because you don’t really know who you’re working with.

A buyer may be honest and have good intentions, but business troubles or political unrest can delay payment or put a buyer out of business.

Also, communication is difficult across thousands of miles, different time zones, and different languages. A letter of credit spells out the details so that everybody is on the same page. Instead of assuming that things will work a certain way, everybody agrees on the process up front.

If you’re familiar with escrow services, the concept is similar: Banks act as “disinterested” third parties. The bank doesn’t take anybody’s side; banks release funds only after certain conditions are met. Letters of credit are common in international trade, but they are also helpful for domestic transactions like construction projects.

Example

-

- A manufacturer receives an order from a new customer overseas. The manufacturer has no way of knowing if this customer can (or will) pay for the goods after producing and shipping the products.

- To manage risk, the seller uses an agreement that requires the buyer to pay with a letter of credit as soon as shipment is made.

- To move forward, the buyer needs to apply for a letter of credit at a bank in their home country. The buyer may need to have funds on hand at that bank or get approval for financing from the bank.

- The bank will only release funds to the seller after the seller proves that the shipment happened. To do so, the seller typically provides documents showing how goods were shipped (with details like the exact dates, destination, and contents). In some ways, the buyer also enjoys protection under a letter of credit: Buyers might prefer to pay a bank with a big legal department rather than send the money directly to an unknown seller.

- If the buyer is concerned about a dishonest seller, there are additional options available for the buyer’s protection. For example, somebody can inspect the shipment before the payment is released.

In Summary

In summary, documentary credits (also known as letters of credit) are:

- Are arrangements by banks for settling international commercial transactions.

- Provide a form of security for the parties involved.

- Ensure payment provided that the terms and conditions of the credit have been fulfilled.

- Mean that payment by such method is based on documents only, and not on merchandise or services involved or underlying commercial contracts.

There are three important points to remember:

- Credits are separate from the contract on which they may be based.

- In documentary credit operations all parties deal only in documents.

- A documentary credit is a means to facilitate the settlement of international trade transactions.

In addition, it should be noted that a documentary credit is not:

- A contract between a buyer and a seller.

- A guarantee that the seller will definitely receive payment.

- A guarantee that the buyer will receive the goods he ordered.

Key Terminology

Lettter of Credit vs Documentary Credit

Both terms are in common usage and are synonymous. There is no distinction between the two but, as ICC rules commonly refer to ‘documentary credits’[ref]In particular UCP 600 and ISBP 745[/ref] , this is the term used within this module.

Sight / Usance

As highlighted in UCP 600 , credit means any arrangement, however named or described, that is irrevocable and thereby constitutes a definite undertaking of the issuing bank to honour a complying presentation.

How Much a Letter of Credit Costs

Banks usually charge a fee for a letter of credit, which can be a percentage of the total credit they are backing. The cost of a letter of credit will vary by bank and the size of the letter of credit. For example, some banks may charge 0.75% of the amount that it’s guaranteeing.

Fees can also depend on the type of letter. In an import-export situation, an unconfirmed letter of credit is less costly. A confirmed letter of credit may have higher fees attached based on the issuing bank’s credit strength.

How to obtain a Letter of Credit

Grand City Investment Limited specializes in providing Documentary Letters of Credit (DLCs), At Sight Letters of Credit (Sight LCs), bank guarantees, standby letters of credit, and expert trade finance solutions.

To request a letter of credit, contact us by Email: apply@grandcityinvestment.com

Bank Instruments Definition, Types, Uses - Grand City Investment Ltd

Posted at 07:01h, 03 October[…] Documentary Letters of Credit (DLC): Requires specific documents (like shipping papers) to trigger payment. […]