07 Oct Finding Genuine SBLC Providers

Finding Genuine SBLC Providers & Trustworthy sources for Bank Guarantees

In order to be sure these genuine providers are dealing with serious prospective buyers of their bank instrument they usually undertake serious checks and balances, this task is usually assigned to banks or financial instrument providers with direct links to them. These financial instrument providers such as Grand City Investment Limited are given the responsibility of making sure a strict screening process is adhered to and only prospective buyers who meet the necessary criteria are allowed access to the Genuine Provider.

How To Find Genuine Standby Letter of Credit (SBLC) Providers

1. HISTORY / EXPERIENCE: The best way to know if your Standby Letter of Credit (SBLC) provider is real or not is to check how many years they have been in business. Personally I will choose a bank instrument provider that has been in business for decades over one that just started a few years ago. Same way I would prefer a medical doctor with 30 years experience over a doctor that has just one or two years experience. History and Experience is everything.

2. Background Check: Run background checks on the company providing the sblc to make sure that they are real and legit.

3. INCORPORATION: Check if sblc provider is a legally registered company or fake one. Ask for their incorporation certificate.

URGENT NOTICE: It might interest you to know that there are only 10 genuine sblc providers in the world and Grand City Investment Limited is amongst the top 5 bank instrument providers in the world. Contact us if you want to know the list of genuine bank guarantee providers in the world and we will be glad to share that information with you.

So if you are in the market for bank instruments such as SBLC (Standby Letter OF Credit) or Bank Guarantee (BG) then make sure you use a reputable Financial Services Provider with decades of experience like Grand City Investment Limited, the benefits of following this approach is to give you peace of mind that your interest would be protected and you surely would be getting the best deal.

The meaning of SBLC:

How can a contractual SBLC be used?

An SBLC is frequently used as a safety mechanism for the beneficiary, in an attempt to hedge out risks associated with the trade. Simplistically, it is a guarantee of payment which will be issued by a bank on the behalf of a client. It is also perceived as a “payment of last resort” due to the circumstances under which it is called upon. The SBLC prevents contracts going unfulfilled if a business declares bankruptcy or cannot otherwise meet financial obligations.

Furthermore, the presence of an SBLC is usually seen as a sign of good faith as it provides proof of the buyer’s credit quality and the ability to make payment. In order to set this up, a short underwriting duty is performed to ensure the credit quality of the party that is looking for a letter of credit. Once this has been performed, a notification is then sent to the bank of the party who requested the Letter of Credit (typically the seller).

In the case of a default, the counter-party may have part of the finance paid back by the issuing bank under an SBLC. Standby Letter of Credit’s are used to promote confidence in companies because of this.

Examples of SBLC

There are two main types of SBLCs—those that are financial-based and those that are performance-based:

- Financial: An exporter sells goods to a foreign buyer, who promises to pay within 60 days. If the payment never arrives, the exporter can collect payment from the foreign buyer’s bank per the terms of the SBLC. Before issuing the letter, the bank typically evaluates the buyer’s credit and determines that the business will repay the bank. For customers whose credit is in question, banks may require collateral or funds on deposit for approval.

- Performance: A contractor agrees to complete a construction project within a certain timeframe. When the deadline arrives, the project is not complete. With an SBLC in place, the contractor’s customer can demand payment from the contractor’s bank. That payment functions as a penalty to encourage on-time completion, funding to bring in another contractor to take over mid-project, or compensation for the headaches of dealing with problems.

What are the Differences Between Standby Letters of Credit and Commercial Letters of Credit?

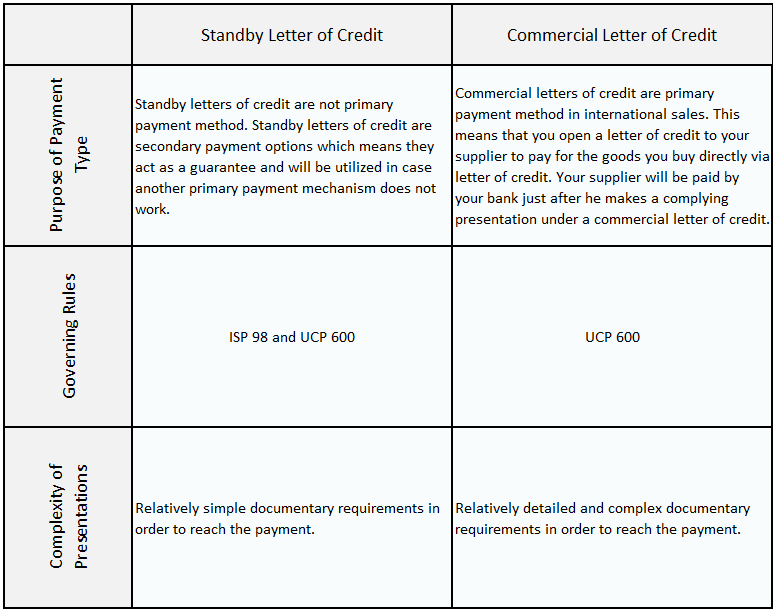

Standby letters of credit and commercial letters of credit are two main documentary credit types used in international trade transactions.

A standby letter of credit is a bank’s undertaking of fulfilling the applicant’s obligations.

In case, the applicant can’t fulfill contractual obligations against the beneficiary of the standby letter of credit, then the beneficiary can apply to the issuing bank for full compensation.

A commercial letter of credit means any arrangement, however named or described, that is irrevocable and thereby constitutes a definite undertaking of the issuing bank to honour a complying presentation.

Commercial letters of credit are mainly used as a primary payment method in export and import of the tangible goods in international trade.

Table 1: Differences Between Standby Letter of Credit and Commercial Letter of Credit

Who Are SBLC Providers?

SBLC Providers are banks and other financial institutions like Grand City Investment Limited that provides SBLC and other bank financial instruments to its customers. The financial instruments such as SBLC, Bank guarantees and letters of credit can be used to obtain loans from banks, they also can be used for trade finance as well as import and export transactions.

Grand City Investment Limited are real sblc providers & genuine bank instrument providers which are specifically for Lease at 4% annual leasing fee. We also provide loans and international project funding, our loan interest rate is 3% per year and you can get loan financing from us without security or collateral.

The loan duration is up to 20 years with a grace period up to 3 years. The best part of our loan funding arrangement is that we do not charge any prepayment penalty. So you can repay the loan on time without penalty.

Standby Letter of Credit (SBLC) Description

1. Instrument: Fully Cash Backed Standby Letter of Credit (SBLC)

2. Total Face Value: Euro/USD 5Million (Min) to Eur/USD 5 Billion (Max)

3. Issuing Bank: HSBC Hong Kong, Barclays Bank London, Citibank New York, Deutsch Bank Germany or any top 20 largest world banks in current year: https://grandcityinvestment.

4. Age: One Year and One Day (with rolls and extensions where applicable)

5. Leasing Price: 4% of Face Value plus 2% brokers commission (Applicable only if there are brokers in the transaction)

6. Delivery: SWIFT MT-760

7. Payment: MT103 Swift Wire Transfer

8. Hard Copy: Bank Bonded Courier within 7 banking days.

Click Here To Apply For SBLC MT760 HSBC, Barclays Bank, Chase Bank, UBS or any Rated Bank.

Or you can contact us by email: apply@grandcityinvestment.com

#FindingGenuineSBLCProviders, #GenuineSBLCProviders, #bankinstrumentproviders, #genuinesblcproviders, #sblcproviders, #SBLCMT760, #RealsblcProviders, #bgsblcprovider, #sblcproviders, #sblc

Get SBLC For Loan & Trade Finance - Grand City Investment Ltd

Posted at 11:06h, 15 September[…] read our previous article titled “ Finding Genuine SBLC Providers” https://grandcityinvestment.com/finding-genuine-sblc-providers/ to understand how to find […]