03 Oct Bank Instruments Definition, Types, Uses

Meaning of Bank Instruments

Bank instruments refer to various financial instruments and documents issued by banks or financial institutions that facilitate transactions, provide guarantees, or serve as evidence of debt.

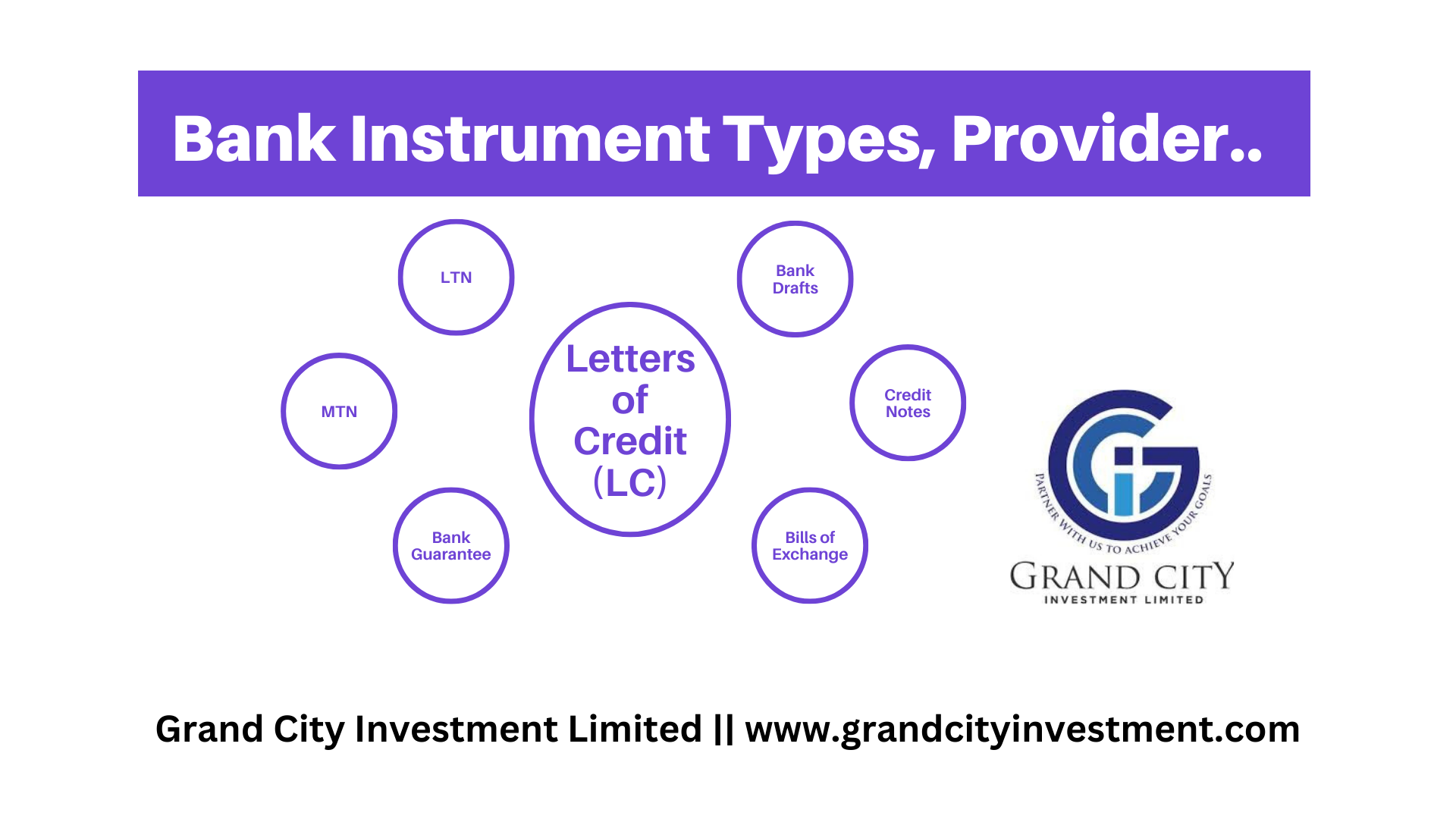

Here are some common types of bank instruments:

Letters of Credit (LC): A bank’s guarantee to pay a seller on behalf of a buyer, provided that certain conditions are met. Variants include:

Documentary Letters of Credit (DLC): Requires specific documents (like shipping papers) to trigger payment.

Standby Letters of Credit (SBLC): Acts as a backup payment method, ensuring payment only if the buyer defaults.

Long Term Notes (LTN): Debt instruments with a longer maturity period, typically issued by companies or governments, allowing them to borrow funds for an extended period at a fixed interest rate.

Cheques: Written orders directing a bank to pay a specific amount from the issuer’s account to a named payee.

Bank Drafts: Similar to cheques, but issued by a bank itself, guaranteeing the payment to the payee.

Bills of Exchange: Written orders binding one party to pay a fixed sum to another party on demand or at a specified time, often used in international trade.

Credit Notes: Documents issued by a seller to a buyer, reducing the amount owed, often used in cases of returns or adjustments.

Bank Guarantees: A bank guarantee is a promise by a lending institution to cover a loss if a business transaction doesn’t unfold as planned. The buyer receives compensation if a party doesn’t deliver goods or services as agreed or fulfill contractual obligations.

These instruments play crucial roles in facilitating transactions, managing risks, and providing credit in both domestic and international markets. They help ensure security, efficiency, and clarity in financial dealings.

What is a Standby Letter of Credit (SBLC)?

Key Takeaways

- A standby letter of credit (SLOC) reassures another party during a business transaction.

- The SLOC guarantees that a bank will financially back the buyer if they can’t complete their sales agreement.

- A SLOC can offer protection for the selling party in the event of bankruptcy.

How a Standby Letter of Credit Works

A SLOC is most often sought by a business to help it obtain a contract. The contract is a “standby” agreement because the bank will have to pay only in a worst-case scenario. Although an SBLC guarantees payment to a seller, the agreement must be followed exactly. For example, a delay in shipping or a misspelling of a company’s name can lead to the bank refusing to make the payment.

There are two main types of standby letters of credit:

- A financial SLOC guarantees payment for goods or services as specified by an agreement. An oil refining company, for example, might arrange for such a letter to reassure a seller of crude oil that it can pay for a huge delivery of crude oil.

- The performance SLOC, which is less common, guarantees that the client will complete the project outlined in a contract. The bank agrees to reimburse the third party if its client fails to complete the project.

Advantages of a Standby Letter of Credit to the Applicant

One of the main benefits of using an SBLC as a guarantee is that it can help the applicant secure a contract, bid, or deal that otherwise might be difficult to obtain. By providing an SBLC, the applicant demonstrates its financial credibility and commitment to the beneficiary and reduces the risk of default or non-performance. An SBLC can also help the applicant negotiate better terms and conditions, such as lower interest rates, longer payment periods, or higher credit limits. Additionally, an SBLC can be tailored to suit the specific needs and requirements of the contract, such as the amount, duration, trigger events, and documents.

Disadvantages of Standby Letter of Credit to the Beneficiary

For the beneficiary, an SBLC provides a high level of assurance and protection against the possibility of non-payment or non-delivery by the applicant. An SBLC is a direct and irrevocable obligation of the issuing bank, which means that the beneficiary can claim the payment from the bank without having to prove or enforce the underlying contract. An SBLC also reduces the risk of currency fluctuations, political instability, or legal disputes that might affect the transaction. Furthermore, an SBLC can be transferred, assigned, or confirmed by another bank, depending on the needs and preferences of the beneficiary.

Risks for the applicant

While an SBLC can offer many benefits for the applicant, it also involves some risks and costs. One of the main risks is that the applicant might lose the SBLC amount if the beneficiary makes a wrongful or fraudulent demand on the bank. This could happen if the beneficiary misinterprets or breaches the contract, or if there is a disagreement or dispute over the performance or quality of the goods or services. Another risk is that the applicant might face difficulties in obtaining or renewing an SBLC, especially if its financial situation or credit rating deteriorates. Moreover, an SBLC can be expensive, as the applicant has to pay fees and charges to the issuing bank, as well as collateral or security deposits.

Risks for the beneficiary

Although an SBLC can provide a high level of security and confidence for the beneficiary, it also carries some risks and limitations. One of the main risks is that the beneficiary might not be able to access the SBLC payment if the issuing bank fails or becomes insolvent. This could happen if the bank faces liquidity problems, regulatory sanctions, or legal actions. Another risk is that the beneficiary might face delays or complications in presenting or verifying the documents required to trigger the SBLC payment. This could happen if the documents are incomplete, incorrect, or inconsistent with the SBLC terms and conditions. Furthermore, an SBLC might not cover all the possible losses or damages that the beneficiary might incur due to the applicant’s default or non-performance.

What is a Bank Guarantee?

Key Takeaways

- A bank guarantee is a promise by a financial institution to meet the liabilities of a business or individual if they don’t fulfill their obligations in a contractual transaction.

- Bank guarantees are largely used outside the U.S. and are similar to American standby letters of credit.

- Bank guarantees are mostly seen in international business transactions, although they may also individuals may need a guarantee to rent property in some countries.

- Different types of guarantees include a performance bond guarantee, an advance payment guarantee, a warranty bond guarantee, and a rental guarantee.

Types of Bank Guarantees

A bank guarantee is for a specific amount and a predetermined period. It clearly states the circumstances under which the guarantee applies to the contract. A bank guarantee can be either financial or performance-based.

In a financial bank guarantee, the bank will guarantee that the buyer will repay the debts owed to the seller. Should the buyer fail to do so, the bank will assume the financial burden itself, for a small initial fee, which is charged by the buyer upon issuance of the guarantee.

For a performance-based guarantee, the beneficiary can seek reparations from the bank for non-performance of the obligation as laid out in the contract. Should the counterparty fail to deliver the services as promised, the beneficiary will claim their resulting losses from non-performance to the guarantor – the bank.

For foreign bank guarantees, such as in international export situations, there may be a fourth party – a correspondent bank that operates in the country of domicile of the beneficiary.

Bank Guarantees vs. Letters of Credit

For a bank guarantee, the primary debtor is the buyer or applicant. Only when the applicant defaults on its obligation, will the bank guarantee step into the transaction. Often, a delayed payment is not a trigger for a bank guarantee. Contrastingly, in the financial instrument termed as a letter of credit, the seller’s claim first goes to the bank.

Thus, a letter of credit offers more confidence that there will be prompt repayment, as the bank is involved in the transaction throughout the process. With a bank guarantee, there must be an inability to uphold the contract on the part of the applicant before the bank becomes involved.

Bank Instrument Providers- Who Are They?

Bank instrument providers refer to various financial institutions provider and documents issued by banks or financial institutions that facilitate transactions, provide guarantees, or serve as evidence of debt.

Bank instrument providers are entities that issue or facilitate the issuance of financial instruments used in banking and trade. Here are some of the key types of bank instrument providers:

- Commercial Banks: The primary issuers of many bank instruments like letters of credit, bank guarantees, and promissory notes. They serve both individuals and businesses.

- Investment Banks: These institutions may issue long-term notes, bonds, and other securities, providing underwriting services and helping corporations raise capital.

- Financial Institutions: This includes credit unions and savings institutions that offer various banking services and may issue certain financial instruments.

- Trade Finance Companies: Specialized firms that provide financing solutions for international trade, often issuing letters of credit and trade-related guarantees.

- Government Agencies: Certain government entities may issue instruments like treasury bills or bonds, which serve as secure investment options.

- Non-Bank Financial Institutions (NBFIs): These include entities like insurance companies and pension funds that may provide bank instruments or guarantees in specific contexts.

- Licensed Money Lenders & Financial Services Providers: These are regulated entities that provide loans and may issue financial instruments related to their lending operations. They can offer financial services similar to traditional banks. Companies like Grand City Investment Limited can provide a range of financial services, including investment opportunities, loans, and other financial instruments tailored to the client’s needs.

Grand City Investment Limited is a Hong Kong based Financial Services Provider that was incorporated on MAY 29, 1984 with Company Registration No. 0137353.

Sorry, the comment form is closed at this time.