04 Oct SBLC Providers & Bank Instrument Providers

Who Are SBLC Providers & Bank Instrument Providers

SBLC Providers and Bank Instrument Providers are banks and financial institutions that issue financial instruments like Standby Letters of Credit (SBLC), Bank Guarantees (BGs), and other types of banking guarantees used in international trade and finance. These providers typically have direct relationships with top-tier banks and facilitate the issuance of these instruments to businesses or individuals who need them to secure transactions or financing.

1. SBLC Providers:

An SBLC provider is a financial institution like Grand City Investment Limited that arranges the issuance of a Standby Letter of Credit (SBLC) on behalf of their clients. The SBLC is a guarantee issued by a bank that serves as a safety net in the event that a party (usually a seller or service provider) fails to meet the terms of a contract. It assures the beneficiary (e.g., a supplier or contractor) that they will be paid in case the applicant defaults.

2. Bank Instrument Providers:

A Bank Instrument Provider is a bank or a financial institution like Grand City Investment Limited that specializes in issuing or facilitating the issuance of various banking instruments like:

- SBLCs (Standby Letters of Credit)

- BGs (Bank Guarantees)

- MTN (Medium-Term Notes)

- Letter of Credit (LC)

- Proof of Funds (POF)

These instruments are often used in trade finance, large-scale contracts, and investment projects, serving as financial security or collateral in business transactions. The providers typically have access to major banks worldwide and can issue these instruments on behalf of their clients or help them obtain these instruments for specific purposes.

How SBLC & Bank Instrument Providers Operate:

- Issuance Process: Providers usually work closely with banks to issue instruments like SBLCs. The application process requires the client to provide documentation (financial records, proof of business, and purpose for the instrument).

- Leasing or Purchasing: Clients may lease a financial instrument for a specific period, often paying a percentage of the instrument’s total value. Alternatively, some clients may purchase the instrument outright.

- Global Reach: Many SBLC providers have partnerships with banks across different financial hubs, including the UK, USA, Germany, Hong Kong, Switzerland, and Singapore, ensuring that the instruments can be issued in multiple currencies and accepted worldwide.

Key Functions of SBLC & Bank Instrument Providers:

- Trade Financing: They help businesses secure trade transactions by offering SBLCs as collateral for payment or performance.

- Project Financing: These instruments can be used to secure large-scale projects in sectors such as real estate, construction, energy, and infrastructure.

- Investment Protection: Some investors use SBLCs to protect their investments or ensure the performance of their business counterparts in joint ventures.

- Letter of Credit Services: They also facilitate the issuance of letters of credit (both standby and documentary) to support international trade.

Who Needs SBLCs and Bank Instruments?

- Importers/Exporters: To secure payments or performance in international transactions.

- Construction Firms: To guarantee performance on large infrastructure projects.

- Businesses Seeking Credit: To enhance their creditworthiness and negotiate favorable financing terms.

- Investors: To secure large-scale investments in sectors such as real estate, energy, and infrastructure.

Reputable SBLC & Bank Instrument Providers:

While there are many providers in the market, it is essential to choose a reputable one that works directly with AAA-rated banks. Trusted SBLC and bank instrument providers, like Grand City Investment Limited, ensure that the instruments are issued through reliable banking channels and are properly authenticated (e.g., using SWIFT network like MT799 and MT760).

Grand City Investment Limited is a legitimate provider of Standby Letters of Credit (SBLC) and bank instruments. We offer SBLC for lease or rent at a 4% annual leasing fee. Additionally, we provide loans and international project funding with a 3% per year interest rate. You can obtain loan financing from us with or without security or collateral. The loan term is up to 20 years, with a grace period of up to 3 years for those in the construction industry. We do not charge any prepayment penalty, allowing you to repay the loan on time without penalty.

Bank Instrument Description:

1. Instrument: Fully Cash Backed Standby Letter of Credit (SBLC) / Bank Guarantee {BG}

2. Total Face Value: EUR/USD 1 Million (Min) to EUR/USD 50 Billion (Max)

3. Issuing Bank: HSBC Hong Kong, Barclays Bank London, Citibank New York, Deutsch Bank Germany, or any AAA Rated Bank.

4. Age: One Year and One Day (with rolls and extensions where applicable)

5. Leasing Price: 4% of Face Value plus 2% brokers commission (Applicable only if there are brokers in the transaction)

6. Delivery: SWIFT MT-760

7. Payment: Swift Wire Transfer

8. Hard Copy: Bank Bonded Courier within 7 banking days.

Financial Solutions for Every Business:

We are a trusted financial instrument provider for Bank Guarantees (BG) and SBLC. As trade finance experts and bank instrument providers (BG/SBLC), we provide reliable financial solutions and can offer you the best deal to meet all your financial goals. Grand City Investment Limited leads in the financial service industry by issuing bank instruments, such as BG Bank Guarantee and Standby Letters of Credit SBLC, with prime-rated banks for clients worldwide. We leverage our relationships with a wide variety of financial institutions and investors to provide the most favorable structure for your business. Your success is our concern.

Financial Instrument Provider (Leased BG / SBLC):

We provide financial instruments and commercial finance services, including BG Bank Guarantees, SBLC Standby Letter of Credit, Deferred Letters of Credit, and Usance LC.

Credit Financing:

We offer flexible and tailor-made credit financing for strategic projects, always tailored to your needs and the requirements of the banking market.

Lease BG SBLC Provider:

Grand City Investment Limited provides bank instruments for business loans and financing various commercial projects.

Bank Guarantee BG:

BG provides a targeted method for securing performance and payment. The bank guarantee is used in both local and international transactions in the import and export business.

What does SBLC mean?

SBLC means Standby Letter of Credit (SBLC). An SBLC is a guarantee of payment by a bank on behalf of their client, fulfilling payment obligations if the client cannot. Financial standby letters of credit ensure financial contractual obligations are fulfilled. A Standby Letter of Credit can also be abbreviated as SBLC or SLOC. A Standby Letter of Credit is different from a Bank Guarantee.

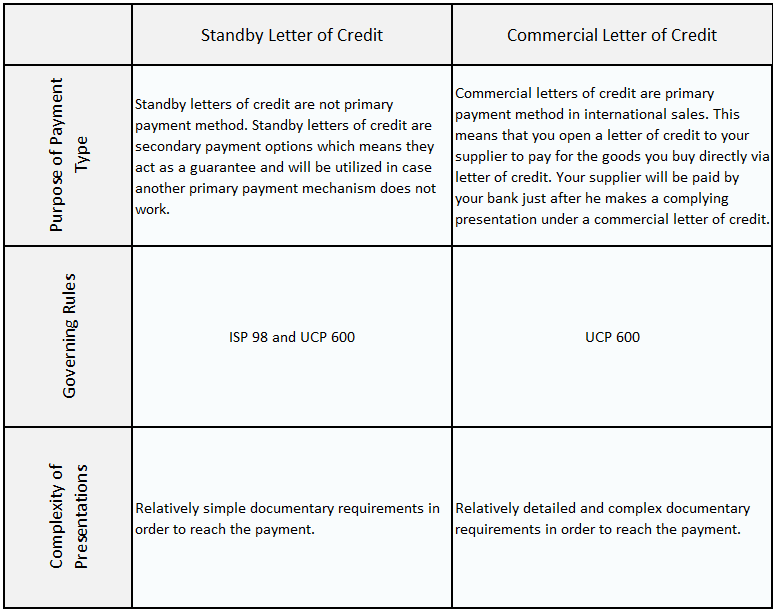

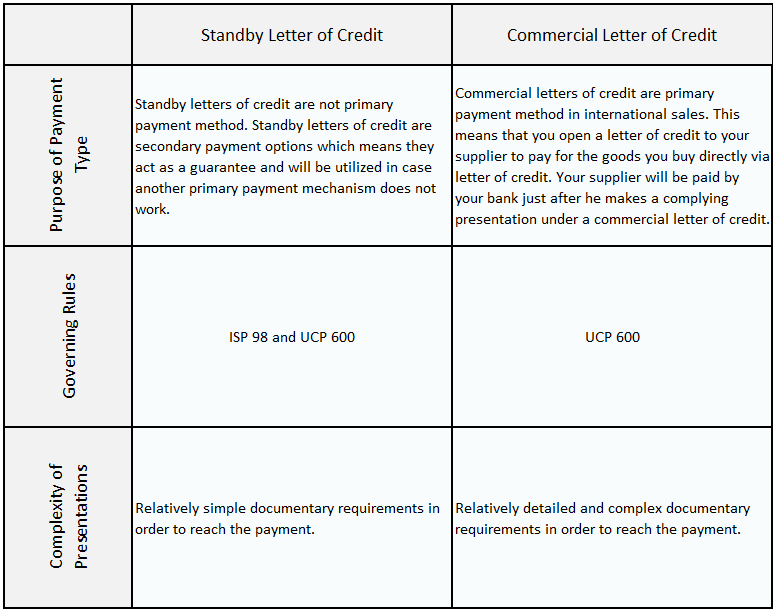

Differences Between Standby Letters of Credit and Commercial Letters of Credit:

Standby letters of credit and commercial letters of credit are two main documentary credit types used in international trade transactions. A standby letter of credit is a bank’s undertaking of fulfilling the applicant’s obligations. In case the applicant can’t fulfill contractual obligations against the beneficiary of the standby letter of credit, then the beneficiary can apply to the issuing bank for full compensation. A commercial letter of credit means any arrangement, however, named or described, that is irrevocable and thereby constitutes a definite undertaking of the issuing bank to honor a complying presentation. Commercial letters of credit are mainly used as a primary payment method in the export and import of tangible goods in international trade.

Table 1: Differences Between Standby Letter of Credit and Commercial Letter of Credit

Common Characteristics of Standby Letters of Credit and Commercial Letters of Credit:

Both standby and commercial letters of credit;

- are irrevocable and conditional payment promises, which is given by a trusted financial institution mostly by a bank.

- independent payment mechanisms, whatever contracts they may base.

- are governed by ICC’s rules, ISP 98 and UCP 600, respectively.

- have a documentary nature.

ISP 98 – International Standby Practices

ISP 98 is the set of rules that governs standby letters of credit. They have been published by ICC Banking Commission. ISP 98 – International Standby Practices ICC Publication No. 590 , 1998 Edition. ISP 98 is in force as of January 1, 1999

ISP 98 – International Standby Practices is the title of the book that is published by ICC to govern the standby letters of credit transactions (SBLC ).

ISP 98 consists of 76 pages in total. Full details of ISP 98 for ordering considerations are as follows : ISP 98 – International Standby Practices ICC Publication No. 590 , 1998 Edition. ISP 98 is in force as of January 1, 1999.

How to Buy ISP 98?

ISP 98 is both available by e-book format and hard copy. It is sold under online ICC Bookstores. You can buy ISP 98 from this link.

sblc Providers & Bank Instrument Providers

Benefit of ISP 98 – International Standby Practices

The benefit of ISP 98 – International Standby Practices

ISP 98 International Standby Practices was written exclusively for standby letters of credit.

Before ISP 98 standby letters of credit were issued under commercial letters of credit rules. This was not an effective way as standby letters of credit and commercial letters of credit have significant differences in scope and practice.

ISP 98 has reduced the cost and time of drafting, limited problems in handling, and avoided countless disputes and unnecessary litigation that have resulted from the absence of internationally agreed rules on standby letters of credit.

International Standby Practices fills an important gap in the marketplace.

The 98 Rules in International Standby Practices (ISP98) offer a precise and detailed framework for practitioners dealing with standby letters of credit.

Developed by the Institute of International Banking Law and Practice, endorsed and published by the International Chamber of Commerce (ICC), ISP98 is the standardized text for the use of standbys worldwide.

ISP98 Rules

- contain precise definitions of key terms such as “original” and “automatic amendment”

- cover in detail the standby process from “Obligations” to “Syndication”

- provide neutral rules acceptable in most situations

- save both time and money in negotiating and drafting standby terms

- help avoid litigation and unexpected loss

- propose basic definitions should the standby involve the presentation of documents by electronic means

- provide international standards for the use of this fast-growing financial instrument

SBLC / Bank Instrument Monetization

Monetization – is the process of liquidating bank instruments (BG/SBLC) by converting them into cash or legal tender.

Grand City Investment Limited are SBLC monetizer. We can arrange and assist clients to discount or monetize any bank instrument, especially SBLC, or arrange a Non-Recourse loan against a Standby Letter of Credit (SBLC) issued from prime banks. The Standby Letter of Credit Monetization arrangement issues Non-Recourse funds to the Client shortly after the Standby Letter of Credit (SBLC) is delivered to the Monetizer.

Our SBLC monetization rate is 80% LTV which is the best rate in the industry, and above all, all our sblc are issued by top AAA rated banks such as HSBC Hong Kong, Barclays Bank London, Citi Bank New York, Credit Suisse etc.

Standard Monetization Terms For BG / SBLC.

- BG and SBLC to be monetized must be issued by top 20 AAA-rated banks such as HSBC, Citi, Barclays, Stanchart etc.

- BG and SBLC from unrated banks cannot be monetized.

- Instruments with a Value of OVER 5 Million Dollars

- BG & SBLC MUST have at least 11 months of validity before expiry

- We prefer monetization transactions of $10 million or more, but we will accept transactions as low as $5 million transaction amount

- Transaction turnaround time between 10 to 14 working days or less

- Exceptions can be made to minimum transaction

- Brokers and intermediaries must have a legally binding agreement

BG / SBLC Monetization Process using the swift system.

- After execution of the BG / SBLC Monetization contract by both parties, the Client will instruct his bank to send SWIFT MT799 to the bank coordinates provided by the Monetizer.

- The Monetizers bank on receipt of the SWIFT MT799 from the client’s bank will reply with a SWIFT MT799.

- On receipt of the Monetizers bank SWIFT MT799 the Clients bank will deliver the Bank Guarantee (BG) / Standby Letter of Credit (SBLC) by SWIFT MT760 to the Monetizers bank.

- Upon receipt, confirmation and delivery of the SWIFT MT760 the Bank Guarantee (BG) / Standby Letter of Credit (SBLC) Monetizer will within maximum four (4) banking days grant a Non Recourse Loan for the LTV as agreed from its nominated bank to the Client.

- The BG/SBLC Monetizer agrees to return the Bank Guarantee (BG) /SBLC unencumbered fifteen (15) calendar days before the 1 year anniversary of the signed contract between the parties.

BG / SBLC Monetization Process using Euroclear:

- After execution of the BG/SBLC Monetization contract by both parties, the Client will instruct his bank to assign the BG/SBLC using FREE Euroclear Delivery to the bank coordinates provided by the BG/SBLC Monetizer.

- The Clients Banker shall immediately email a certified Euroclear execution receipt of the Bank Guarantee (BG) Standby Letter of Credit (SBLC) delivery to the Bank Guarantee Monetizer.

- Upon receipt and confirmation of the Euroclear assignment and delivery, the Bank Guarantee /Standby Letter of Credit (SBLC) Monetizer will within maximum three (3) banking days grant a Non Recourse Loan for the LTV as agreed from its nominated bank to the Client.

- The BG/SBLC Monetizer agrees to return the Bank Guarantee (BG) / Standby Letter of Credit (SBLC) unencumbered fifteen (15) calendar days before the 1 year anniversary of the signed contract between the parties.

Estimated Completion Time For SBLC Monetization:

The SBLC Monetization process typically takes within 10 Days after all documents are signed and verified or 3 to 4 Days After Instrument Delivery on the SWIFT or Euroclear Networks.

SBLC Process & How To Obtain SBLC

We have been providing these bank financial instruments to our numerous customers all over the world including importers, exporters as well as business owners that need credit enhancements or trade finance facilities to execute projects locally / internationally.

No Comments