07 Sep Genuine SBLC Provider

Genuine SBLC Provider

Who is a Genuine SBLC Provider? How Does One Find A Genuine BG/SBLC Provider?

Genuine SBLC Provider is a bank or financial services provider like Grand City Investment Limited that provides real and genuine SBLC from prime banks without failure or stories.

Features & Characteristics Of Genuine BG/SBLC Providers

2. Total Face Value: Eur 5M MIN and Eur 10B MAX (Ten Billion USD).

3. Issuing Bank: HSBC Bank Hong Kong, Credit Suisse, Chase Bank, Citibank, Barclays Bank London and Deutsche Bank Frankfurt Germany

4. Age: One Year, One Month

5. Leasing Price: 4% of Face Value plus 2% commission fees to brokers.

6. Delivery: Bank to Bank swift.

7. Payment: MT-103 or MT760

8. Hard Copy: Bonded Courier within 7 banking days.

What is a Standby Letter of Credit (SBLC / SLOC)?

The standby letter of credit also known as SBLC is a bank guarantee document whereby the buyer guarantees to his creditor (usually the supplier) that his bank will be able to substitute himself as debtor in case of default subject to that the exporter presents to the bank the proof of existence of the claim.

It is therefore a documentary guarantee, payable on first request, which is intended to secure the performance of a contract, obligation or flow of business transactions.

The SBLC should not be confused with the documentary credit which is instead a means of payment since the buyer goes to his bank and asks him to pay the seller at a given moment, ie on a date or to the fulfillment of a condition (delivery for example).

In principle if all goes well, the letter of credit will not have to be put into play, it is an additional guarantee, a kind of guarantee of the bank so that the beneficiary is assured of collecting the amount of his debt, it is therefore not a payment instrument but a financial contract that comes in addition to the marketing contract.

Generally the SBLC is required by the beneficiary but it is the debtor who makes the request from his bank which is the issuing bank, the creditor or supplier will be notified by the notifying bank.

The issuing bank commits, for a fixed period, on the instruction of its client, the client, to pay a certain amount to a beneficiary in the event of default by his client.

If the debtor is not solvent, it is indeed the issuing bank which will have to repay the notifying bank, at charge for it to be then refunded by the debtor.

If the debtor is not solvent, it is indeed the issuing bank which will have to repay the notifying bank, with charge for it to be then refunded by the debtor.

The advantages of the stand-by letter of credit

It is above all an additional guarantee for the seller which allows to realize the act of marketing in better conditions and even to accept means of payment upstream easier to implement like the bank transfer for example, transfer which can be staggered while making sure to benefit from the bank guarantee.

Moreover, in the context of commercial operations, this tool is very practical for operations whose flows are repetitive.

For example, in a long-term or usual business relationship, a supplier who carries out transactions with a buyer every month for large amounts and sometimes even initiates delivery before receiving the payment will be assured of having the funds in case in this situation the letter of credit may only be put in place once at the beginning of the commercial relationship and be used for all transactions, provided that the amount does not exceed that guaranteed, that such conditions have been provided for in the financial contract and that the debtor is in default.

Another advantage is that its cost is lower than the documentary credit.

Exchanges are facilitated (The SBLC facilitates exchanges that do not have to be formatted as with a documentary credit).

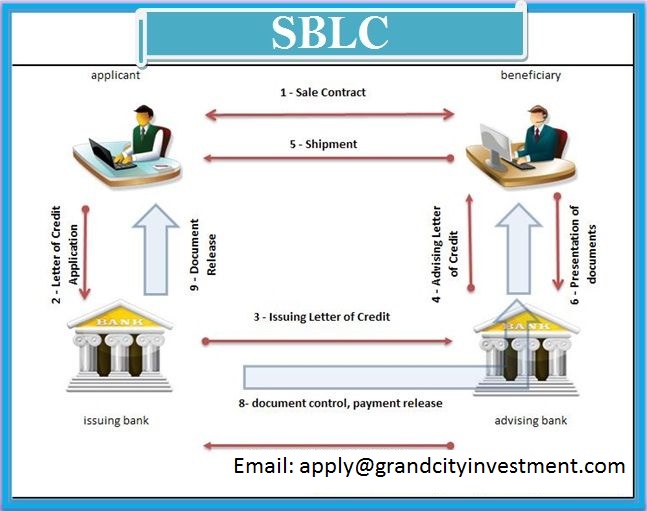

Diagram of the establishment of the standby letter of credit

In a client / supplier business relationship in which the customer is the debtor and the supplier the creditor, it is the debtor who initiates the request for a stand-by letter of credit from a banking institution.

The SBLC will either be sent directly to the supplier by the customer or sent by the issuing bank to the notifying bank. In the event of default, the supplier may require the notifying bank to immediately pay the sums due by the debtor provided that he justifies the invoices on the basis of the existence of the claim.

The notifying bank sends the request for payment, with supporting documentation, to the issuing bank, which transmits the funds to the notifying bank which itself pays the debtor.

• Establishment of the SBLC

• SBLC activation in case of failure

- Negotiation of the contract: The seller and the buyer agree on the terms of the contract, the amount of the sale. The seller will then be debtor of this sum of money and the buyer will be creditor.

- Request for issuance of the stand-by letter of credit: the debtor, customer or buyer, asks his bank to set up the stand-by letter of credit.

- Either it is a direct stand-by and the bank issues the letter of credit directly to the beneficiary (creditor who is the supplier), or it is an indirect stand-by and the issuing bank transmits the stand by to the corresponding bank in the beneficiary’s country.

- Notification or confirmation of the SBLC: if it is a direct standby, the correspondent bank notifies the beneficiary ie the seller, if it is an indirect standby, the notifying bank or confirming notify the beneficiary’s bank.

- In case of default and to activate the SBLC, the seller hands over to the notifying bank the proof of the claim, for example the proof that an invoice is unpaid by simple presentation of a written certificate mentioning the breach of the commitments of the buyer , the non-payment.

- The notifying or confirming bank transmits these documents to the issuing bank which controls them and in case of validity of the documents:

- The issuing bank makes the payment, it is obliged to do so even if its bond raises a non-performance exception, that is to say even if its client indicates to it that it voluntarily does not proceed to the payment since its the other party has not performed its own obligations (eg the goods are defective).

- The seller is compensated, now charges the issuing bank to turn against his client to get refund.

NB: when the beneficiary is directly notified by the issuing bank, it is called stand-by direct. On the other hand, it is indirect when the beneficiary requires the intervention of his bank, the notifying bank or the confirming bank when, at the same time, the bank undertakes to pay the beneficiary, this confirmation makes it possible to avoid the country risk (non-transfer of funds).

The different types of SBLC

There are many types of SBLC, the most common are those used in international business relations. The SBLC can be used to protect the seller or the buyer, the most common is certainly the one that protects the seller in case of non payment of the buyer but the buyer can also ask to implement this type of guarantee for protect against possible non-performance or partial performance of the seller.

• SBLC in Seller Protection:

• SBLC in Buyer Protection:

The SBLC of good execution: it makes it possible to guarantee to the purchaser the payment of an indemnity in the event of partial execution or non execution of the obligations of the salesman. This would be the situation in which a buyer who has made the payment of the entire order reserves a guarantee of compensation if the supplier only delivers half of the order (for lack of stock for example) or he does not deliver in time. In this case the SBLC is requested by the supplier from his bank and not by the buyer since he is the beneficiary.

The SBLC of refund of deposit: It makes it possible to guarantee to the purchaser the repayment of the installments in the event of non fulfillment of the obligations of delivery by the salesman.

The SBLC waiver of guarantee guarantee to guarantee the purchaser the repayment of the last term of payment if the contract is not correctly executed (for example the merchandise shows failures, the works are of bad quality, …).

The commercial SBLC is the most common, it allows to guarantee the seller against the risks of nonpayment of the buyer or against his risk of insolvency as part of their commercial commitments.

SBLC Bid: This letter of credit ensures that the bidder pays compensation in the event of non-performance of the bidder’s obligations. In this sense, offering a bid guarantee is a good way to stand out from the competition and to show its seriousness in the context of a call for tenders.

The advantages of the letter of credit in an international setting

The standby letter of credit is an effective tool for securing international trade commitments. The legal regime and the scope of the letter of credit are based on stable and recognized international and community rules between the various states, which allows for a harmonized legal framework accepted by the contracting parties’ countries.

The letter of credit must mention the rules to which it is subject, ie the Uniform Rules and Uses relating to Documentary Credits (UCR 600 of the International Chamber of Commerce) or the International Rules and Practices relating to standby (RPIS 98 of the International Chamber of Commerce).

The SBLC is therefore a good alternative to the implementation of complex international contracts and conventional international guarantees. In addition, any SBLC is limited in time, so the end date of engagement is known.

The SBLC is a simple and powerful tool: The LCSB is relatively simple to set up provided you go through a professional body, for the writing of the letter of credit you will have to gather a number of element and present the situation in order to have it written.

The documents provided are checked only in the event of default and thus implementation of the letter of credit, unlike the documentary credit whose documents are checked beforehand. The letter of credit has the advantage of being flexible in its drafting, you can choose there the amount, the service or the object of the guarantee, the duration, the conditions of implementation, …

Announce the possibility of setting up an SBLC with your co-contractor will facilitate your exchanges and position you in a better position for your negotiations in trade. It is also a good alternative for documentary credit to guarantee recurring transactions between trading partners whose relations are habitual and perennial.

Why the standby letter of credit is a stable and secure guarantee?

It is above all autonomous, that is to say that it is perfectly independent of the commercial relationship contract between the seller and the buyer.

Thus, if the contract does not result in the guarantee, if one of the co-contractors invokes a non-performance exception, the guarantee can still be invoked.

Indeed, an exception of non-performance allows a contracting party not to fulfill one of the obligations of the contract if the other contracting party does not execute it himself, so the seller who will not execute his delivery correctly could still invoke payment upon presentation of the invoice.

Of course, the conditions of implementation of the letter of credit are to be defined in the SBLC so as not to hurt any of the contractors but in any case it means that in case of disagreement or litigation, the guarantee can still be activated. and therefore the seller will not have to wait for the outcome of a lawsuit or a decision of the buyer to receive the funds.

The letter of credit is indeed payable on first request, the beneficiary may require payment on presentation of documents to the issuing bank. The SBLC is also irrevocable and can not be canceled without the agreement of all parties to the guarantee.

How much does it cost to do an SBLC?

Grand City Investment Limited is a StandBy Letter of Credit (SBLC) provider @ 4% leasing fee per year. Most banks and other financial institutions charge a standard fee of between 1-10% of the SBLC value. In the event that the business meets the contractual obligations prior to the due date, it is possible for an SBLC to be ended with no further charges.

Click Here to apply for SBLC or Bank Guarantee from AAA rated banks in UK, USA, France, Germany, London, Switzerland, Singapore, Malaysia, Indonesia, Turkey or Dubai.

No Comments