18 Sep Bank Guarantee Meaning, Types, Uses (2024)

What Is a Bank Guarantee? How They Work, Types, and Examples

Few days ago, we wrote a Comprehensive Guide about Standby Letters of Credit, but today, we will focus on Bank Guarantees (BG), Meaning, Types and Uses.

As a business owner, if you are looking to engage in international transactions, you have several available payment options to choose from. However, they are not without their risks – for example, your contracts and transactions may fail to be upheld for various reasons, resulting in non-payment. To facilitate these international operations and as a safety net, you may use a bank guarantee. This is especially popular outside of the United States. You should learn what it is and how it could assist your business operations.

Bank Guarantee Definition: What Is a Bank Guarantee?

A bank guarantee is a financial backstop offered by a financial institution promising to cover a financial obligation if one party in a transaction fails to hold up their end of a contract. It is a promise made by a financial lending institution to cover unfulfilled contracts should their borrower defaults.

Generally used outside the United States, a bank guarantee enables the bank’s client to acquire goods, buy equipment, or perform international trade. If the client fails to settle a debt or deliver promised goods, the bank will cover it.

This way, by paying a certain fee, your business can be covered should the worst happen. If your business has a client that fails to settle their debt or deliver what they promise, you would still receive what you are owed. Thus, your operations can still be run and be expanded with minimum risk.

Understanding Bank Guarantees

As already explained, a bank guarantee is a promise by a lending institution to cover a loss if a business transaction doesn’t unfold as planned. The buyer receives compensation if a party doesn’t deliver goods or services as agreed or fulfill contractual obligations.

Do Banks in the U.S.A. Issue Bank Guarantees?

The simple answer is NO. Banks in the United States of America do not issue bank guarantees. Instead, they issue standby letters of credit serving the same purpose.

Non-U.S. financial institutions and intermediaries in countries such as Germany, France, Spain, Austria, Belgium, the United Kingdom, and elsewhere may more heavily rely on bank guarantees in commercial transactions. But sometimes, a bank guarantee may help an individual rent a property.

Bank guarantees from a reputable institution can help you establish business relationships, increase your access to cash flow and capital, protect your business from losses, and set you up for international opportunities.

Bank Guarantee vs. Standby Letter of Credit: What’s the Difference?

A Bank guarantee is not the same as a standby letter of credit, although with both instruments the issuing bank accepts a customer’s liability if the customer defaults. With a guarantee, the seller’s claim goes first to the buyer, and if the buyer defaults, then the claim goes to the bank. With letters of credit, the seller’s claim goes first to the bank, not the buyer. Although the seller will likely get paid in both cases, letters of credit offer more assurance to sellers than guarantees generally do.

Legal Difference – There is a big legal difference between a bank guarantee and a Standby LC. A bank guarantee is an obligation subject to civil law whereas a standby Letter of credit is subject to banking protocols.

Scope of Practicality – A Bank Guarantee is more practical than a standby Letter of credit.

Bank guarantees are commonly used by contractors while letters of credit are issued for importing and exporting companies.

As already explained above, in the USA, banks do not issue bank guarantees, they issue Standby Letters of Credit (SBLC) which serves the same purpose.

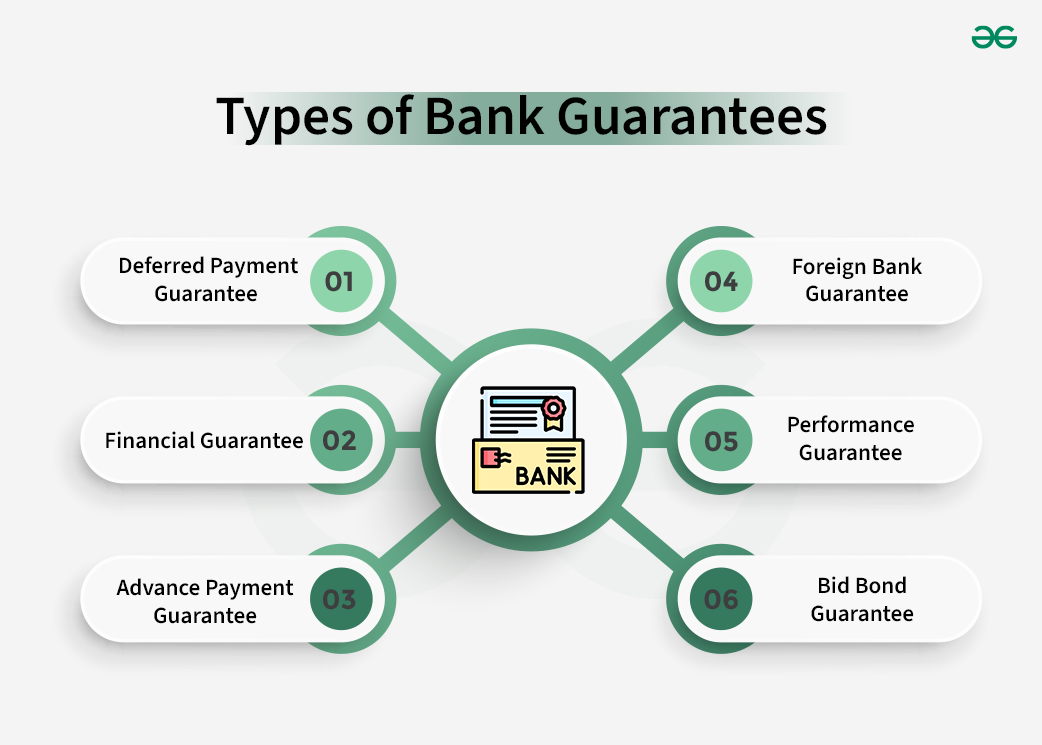

Types of Bank Guarantees

There are many different kinds of Bank Guarantees namely:

- A Payment Guarantee assures a seller the purchase price is paid on a set date.

- Shipping guarantees: This kind of guarantee is given to the carrier for a shipment that arrives before any documents are received.

- Loan guarantees: An institution that issues a loan guarantee pledges to take on the financial obligation if the borrower defaults.

-

Bid bond guarantees: In a bid bond guarantee, the bond owner is entitled to a compensation if the bidder does not start a project that has been agreed on. The purpose is to provide a guarantee to the bond owner that the bidder will do and finish work as agreed if they are selected.

- A Performance Bond serves as collateral for the buyer’s costs incurred if services or goods are not provided as agreed in the contract.

- Advanced payment guarantees: This guarantee acts to back up a contract’s performance. Basically, this guarantee is a form of collateral to reimburse advance payment should the seller not supply the goods specified in the contract.

- Confirmed payment guarantees: With this irrevocable obligation, a specific amount is paid by the bank to a beneficiary on behalf of the client by a certain date.

KEY TAKEAWAYS

1. A bank guarantee is a promise by a financial institution to meet the liabilities of a business or individual if they don’t fulfill their obligations in a contractual transaction.

2. Bank guarantees are largely used outside the U.S. and are similar to American standby letters of credit.

3. Bank guarantees are mostly seen in international business transactions, although individuals may also need a guarantee to rent property in some countries.

4. Different types of guarantees include a performance bond guarantee, an advance payment guarantee, a warrantee bond guarantee, and a rental guarantee.

Deciding Which Bank Guarantees (BG) that you Need

Please keep in mind the following information:

Bank Guarantees (BG) come in different types and cover a wide range of warranties. Your business may or may not require one of them to support its operations. Choosing the right type of guarantee for your business may seem overwhelming, but simple steps can help:

Real-World Example

Bank guarantees protects both parties in a contractual agreement from credit risk.

Example 1: A construction company and its cement supplier may enter into a contract to build a mall. Both parties may have to issue bank guarantees to prove their financial bona fides and capability. In a case where the supplier fails to deliver cement within a specified time, the construction company would notify the bank, which then pays the company the amount specified in the bank guarantee.

Example 2: St. Mary’s Hospital is a London based medical facility looking to purchase $5 million in medical equipment from Germany. The Germany based equipment vendor insists that St. Mary’s Hospital provide a bank guarantee to cover payments before they ship the equipment. St. Mary’s Hospital requests a guarantee from a lending institution, such as Grand City Investment Limited, which holds its cash accounts. Essentially, Grand City Investment Limited cosigns the purchase contract with the vendor.

Advantages of Bank Guarantees

Bank guarantees are helpful for many people and companies who are doing different kinds of transactions. Here are some of the best advantages bank guarantees.

1. Risk Mitigation: Bank guarantees provide a valuable advantage by offering peace of mind and reducing risk for all parties involved in a transaction. They assure both buyers and sellers that their interests will be safeguarded in the event of non-performance or failure.

2. Credibility: A bank guarantee makes the person giving it look more trustworthy. It shows that you are committed and have a lot of money, which can be very important in business deals, especially with people you don’t know.

3. Bid Sucess in Tender: If you win a tender, you’ll get an advantage. When people bid on contracts or tenders, a bid bond or proposal guarantee makes it more likely that they will win. It shows how serious the bidder is and that they have the money to meet the standards of the contract.

4. Enables Global Trade: When you deal with other countries, bank guarantees are often accepted. They help people from different countries trust each other more, which makes it easier for businesses to do business across borders.

5. Flexible Payment Alternatives: Bank promises give you options for how to pay. As an example, an advance payment promise lets buyers get advance payments and gives sellers peace of mind that the money will be used correctly.

6. Smooth Real Estate Deals: When buying or selling real estate, bank guarantees are often used to make sure that rent is paid on time or that building projects are finished. Adding this protects both of you even more.

7. Contractual Compliance: Bank guarantees make sure that the rules of the contract are followed. Performance promises, for example, reassure the buyer that the seller will follow through on their end of the deal, which builds trust in the deal.

8. Compliance with Customs and Import/Export Rules: In foreign trade, bank guarantees are useful for making sure that customs duties, taxes, and other rules are followed. They make it faster for things to move across borders.

9. Help with Loans and Credit: You can use bank guarantees to support loan applications or credit agreements. They enhance the client’s creditworthiness and provide lenders with confidence regarding repayment.

10. Protection in Advance Payments: Parties making advance payments can use bank guarantees to ensure that the money is secure. This ensures that the loan is used for its intended purpose and provides the borrower with a means to recover their funds if the terms are not met.

In conclusion, bank guarantees are beneficial as they reduce risks, build trust, and facilitate various types of transactions. Due to their versatility, they are valuable in a wide range of business scenarios.

Obtaining Bank Guarantees (BG):

Who is a Bank Guarantee Provider?

A bank guarantee provider is a bank or lending institution like Grand City Investment Limited, that assists customers in obtaining bank guarantees and other financial instruments such as BG, SBLC etc.

Top Bank Guarantee Providers: Why Grand City Investment Limited is Your Premier Standby Letter of Credit Provider and Genuine Bank Guarantee Provider.

Grand City Investment Limited is a licensed money lender with a rich history. Incorporated in Hong Kong on May 29, 1984 (Company Registration No. 0137353), we operate under the Money Lenders Ordinance (Chapter 163 of the Laws of Hong Kong). As a premier provider of trade finance solutions, we specialize in various financial instruments, including Standby Letters of Credit (SBLC), Bank Guarantees (BG), Usance Letters of Credit etc. Our mission is to support businesses, SMEs, and individuals in securing the funding they need, when they need it, and how they need it.

Comprehensive Financial Services

At Grand City Investment Limited, we provide an extensive array of financial services designed to meet diverse client needs:

- Loans: Personal and business loans, secured and unsecured options, recourse and non-recourse loans.

- Bank Guarantees: Performance guarantees, tender bonds, and advance payment guarantees.

- Letters of Credit: Including red clause letters of credit, usance LC, SBLC, and documentary letters of credit.

- Proof of Funds (POF): Pre-advice messages and bank comfort letters.

- Bank Instruments: Options to purchase or lease bank guarantees and standby letters of credit.

- Wealth and Portfolio Management: Tailored strategies for asset growth.

- Insurance and Underwriting Services: Comprehensive coverage solutions.

- Private Placement Programs and Trading Platforms: Innovative investment opportunities.

- Corporate Finance and Investments: Strategic financial solutions for businesses.

PLEASE READ: How To Find Genuine BG/SBLC Providers

Partnership with Top-Rated Banks

Our bank instruments are issued through top-tier, AAA-rated banks, including:

- Citibank New York

- JP Morgan Chase Bank

- Wells Fargo Bank

- Bank of America

- HSBC (Hong Kong and London)

- Barclays Bank (London)

- Standard Chartered Bank (London, Dubai, and Hong Kong)

- UBS Switzerland

- Deutsche Bank AG (Germany)

These partnerships ensure that our financial instruments are backed by top and reliable financial institutions, offering our clients peace of mind and security.

Why Choose Grand City Investment Limited?

1. Proven Track Record

With over 40 years of successful service in the finance industry, we have built a reputation for excellence.

2. Legally Licensed

As a licensed money lender registered with the Hong Kong government, we operate with integrity and transparency. Our clients can trust that they are working with a legitimate and reputable provider.

3. Tailored Financial Solutions

We understand that each client has unique needs. Whether you are seeking funding for a new project, expanding your business, or exploring investment opportunities, we offer customized financial solutions to meet your needs.

4. Competitive Pricing

We issue BGs and SBLCs in both USD and Euro currencies @ 4% annual leasing fee, ensuring flexibility for our clients. Our pricing structure is straightforward, with no hidden fees or prepayment penalties.

5. Commitment to Privacy

Your privacy is paramount. We ensure that all client data and business transactions remain confidential and are not shared with third parties.

6. Broker Support and Compensation

We value our brokers and offer competitive commissions ranging from 1% to 2% on every deal. New brokers are always welcome and are protected against circumvention.

7. Experienced Team

Our staff consists of qualified professionals with extensive experience in the financial industry. We pride ourselves on being efficient, consistent, and reliable, providing fast approvals and closings.

8. Satisfied Clients

Our commitment to exceptional service has resulted in a loyal client base and numerous success stories. We prioritize client satisfaction and strive to exceed expectations.

Our Unique Advantages

- Direct Access to Major Banks: We issue instruments from the world’s top 20 largest banks, ensuring reliability and credibility.

- Comprehensive Offerings: Our range of services addresses various financial needs, making us a one-stop solution for clients.

- Transparency: We believe in clear communication and honest dealings, ensuring that clients understand every aspect of their transactions.

- Rapid Response Times: Our streamlined processes allow for quick turnaround times, getting you the funding you need when you need it.

For businesses and individuals seeking reliable bank guarantees and standby letters of credit, Grand City Investment Limited is the number one choice. Our extensive experience, commitment to client satisfaction, and partnerships with top-rated banks position us as a leader in the financial services industry.

We invite brokers and agents to partner with us. By becoming a Grand City Investment broker, you’ll enjoy competitive commissions and access to our comprehensive suite of financial services. Join us in helping clients succeed.

CONTACT US

For more information about our services or to initiate your financial instrument needs, please contact us using the following methods:

- Email: apply@grandcityinvestment.com

- Website: www.grandcityinvestment.com

What is StandBy Letter of Credit (SBLC)? - Grand City Investment Ltd

Posted at 16:10h, 18 May[…] of Credit (SBLC) is different from a Bank Guarantee (BG). Read about bank guarantees here: https://grandcityinvestment.com/what-is-bank-guarantee/ Grand City Investment Limited is a Standby Letter of Credit (SBLC) Provider. We also provide […]

How to Reopen Your Small Business Safely - Grand City Investment Ltd

Posted at 05:05h, 22 May[…] are your preferred destination for Business Loans, Financing, Lease Bank Guarantees, Letter of Credit, Lease Standby Letter of Credit, Insurance & Wealth Management, Portfolio […]

Loans, Financing, Lease BG & Lease SBLC- Grand City Investment Limited - Grand City Investment Ltd

Posted at 06:58h, 30 May[…] are Lease Bank Guarantee Providers, Letter of Credit, Lease Standby Letter of Credit, Insurance & Wealth Management, Portfolio […]

what is Bank Instrument - Grand City Investment Ltd

Posted at 22:03h, 01 June[…] the buyer will be happy with the goods. A standby letter of credit can also be abbreviated SBLC. What is Bank Guarantee? is a kind of guarantee from a financing organization. The bank guarantee signifies a lending […]

Unlocking Business Growth with Grand City Investment Limited: Your Trusted Partner for Loans, Bank Instruments, and Trade Finance - Grand City Investment Ltd

Posted at 14:45h, 04 October[…] Bank Guarantee (BG) is another type of financial instrument that guarantees a business’s ability to fulfill a […]

What Is BG/SBLC/SLOC and How Does BG SBLC Funding Work? - Grand City Investment Ltd

Posted at 15:25h, 04 October[…] What is Bank Guarantees (BG) […]

Genuine Bank Guarantee Providers and BG/SBLC Leasing Options - Grand City Investment Ltd

Posted at 19:35h, 04 October[…] Guarantees (BG) A Bank Guarantee (BG) is a promise made by a bank to cover a financial loss if the borrower fails to fulfill the […]