12 Oct Identifying a Genuine SBLC Provider

Who is a Genuine SBLC Provider?

A genuine SBLC (Standby Letter of Credit) provider is typically a bank or reputable financial service provider like Grand City Investment Limited that offers SBLCs as a guarantee of payment, contingent on certain conditions being met.

An SBLC is a guarantee issued by a bank on behalf of a client, promising payment to a third party if the client fails to meet their obligations.

Here are some key factors to look for in a genuine SBLC provider:

1. Reputable Financial Institution or Bank

-

The Genuine SBLC Provider provider should be a well-known, internationally recognized bank or financial institution.

-

The institution should have a solid reputation and be compliant with international financial regulations.

2. Transparency and Clear Terms

-

A genuine provider should offer transparent and clear terms for the SBLC. All the conditions of the SBLC should be outlined, including how to call upon it if necessary.

-

Any fees and charges associated with the issuance of the SBLC should be clearly explained.

3. Experience and Track Record

-

Genuine providers usually have a track record of successfully issuing SBLCs and a history of maintaining relationships with clients, particularly in international trade and finance.

4. Licensing and Regulation

The Genuine SBLC Provider should adhere to the guidelines set by organizations like the International Chamber of Commerce (ICC) or Uniform Customs and Practice for Documentary Credits (UCP 600).

The Genuine SBLC Provider provider should be licensed and regulated by relevant authorities in the jurisdiction where they operate. A good example is Grand City Investment Limited, a Licensed Money Lender that was incorporated in Hong Kong on MAY 29, 1984 with Company Registration No. 0137353 under the Money Lenders Ordinance (Chapter 163 of the laws of Hong Kong). They are the premier provider of SBLC, Bank Guarantees, Trade Finance, Business Loans, Insurance, International Project Funding, Investments, Wealth Management, Portfolio Management, Trade Platforms, Private Placement Programs, and SBLC Monetization.

All our SBLC and bank guarantees are issued through top AAA rated banks such as Citibank New York, Chase Bank, Wells Fargo Bank, Bank of America, HSBC Hong Kong or HSBC London, Barclays bank London, Standard Chartered Bank London, Dubai or Hong Kong, UBS or Credit Suisse in Switzerland, Deusche Bank AG Germany etc.

Our bank guarantees and SBLCs are Cash-Backed and Stand as Obligations from our Bank on behalf of our Clients for their Credit needs and business and Project Funding. These SBLCs can be used to secure Funding for Projects, Business Expansions, Private Placement Programs (PPP) as well as SBLC monetization services.

What Is a Standby Letter of Credit (SBLC or SLOC)?

A standby letter of credit (SBLC / SLOC) is a legal document that guarantees a bank’s commitment of payment to a seller if the buyer–or the bank’s client–defaults on the agreement. A standby letter of credit helps facilitate international trade between companies that don’t know each other and have different laws and regulations. Although the buyer is certain to receive the goods and the seller is certain to receive payment, a SLOC doesn’t guarantee the buyer will be happy with the goods. A standby letter of credit can be abbreviated SBLC or SLOC.

How a Standby Letter of Credit Works

A SLOC is most often sought by a business to help it obtain a contract. The contract is a “standby” agreement because the bank will have to pay only in a worst-case scenario. Although an SBLC guarantees payment to a seller, the agreement must be followed exactly. For example, a delay in shipping or a misspelling of a company’s name can lead to the bank refusing to make the payment.

There are two main types of standby letters of credit:

-

A financial SLOC guarantees payment for goods or services as specified by an agreement. An oil refining company, for example, might arrange for such a letter to reassure a seller of crude oil that it can pay for a huge delivery of crude oil.

-

The performance SLOC, which is less common, guarantees that the client will complete the project outlined in a contract. The bank agrees to reimburse the third party if its client fails to complete the project.

IMPORTANT: The recipient of a standby letter of credit is assured that it is doing business with an individual or company that is capable of paying the bill or finishing the project.

The procedure for obtaining a SLOC is similar to an application for a loan. The bank issues it only after appraising the creditworthiness of the applicant.

Click here to learn how to spot fake bank guarantee providers and fake SBLC providers.

Letter of Credit

In the worst-case scenario, if a company goes into bankruptcy or ceases operations, the bank issuing the SLOC will fulfill its client’s obligations. The client pays a fee for each year that the letter is valid. Typically, the fee is 1% to 10% of the total obligation per year.

Advantages of a Standby Letter of Credit

The SLOC is often seen in contracts involving international trade, which tend to involve a large commitment of money and have added risks.

For the business that is presented with a SLOC, the greatest advantage is the potential ease of getting out of that worst-case scenario. If an agreement calls for payment within 30 days of delivery and the payment is not made, the seller can present the SLOC to the buyer’s bank for payment. Thus, the seller is guaranteed to be paid. Another advantage for the seller is that the SBLC reduces the risk of the production order being changed or canceled by the buyer.

An SBLC helps ensure that the buyer will receive the goods or services that are outlined in the document. For example, if a contract calls for the construction of a building and the builder fails to deliver, the client presents the SLOC to the bank to be made whole. Another advantage when involved in global trade, a buyer has an increased certainty that the goods will be delivered from the seller.

Also, small businesses can have difficulty competing against bigger and better-known rivals. An SBLC can add credibility to its bid for a project and can oftentimes help avoid an upfront payment to the seller.

CLICK HERE TO GET A STANDBY LETTER OF CREDIT (SBLC) FROM ANY PRIME BANK IN EUROPE OR USA.

LC Vs. SBLC

Both the regular letter of credit and standby letter of credit are payment instruments used in international trade. However, there are some basic differences in the product which we will discuss in the following post –

SBLC Meaning

A letter of credit is a promise from the bank that the buyer i.e. importer will fulfill his payment obligation and pay the full invoice amount on time. The role of the issuing bank is to make sure that the buyer pays. In case the buyer is unable to fulfill his obligation, the bank will pay to the seller i.e. the exporter, but the funds come from the buyer.

On the other hand, a standby letter of credit is a secondary payment method where the bank guarantees the payment when the terms of the letter of credit are fulfilled by the seller. It is a kind of additional safety net for the seller. The buyer may not pay the seller due to multiple reasons such as cash flow crunch, dishonesty, bankruptcy, etc. But as long as the seller meets the requirement of a standby letter of credit, the bank will pay.

Features within the Instrument

A letter of credit does not have any specific features that the buyer must adhere to for the completion of a transaction. It does have basic requirements such as documentation, packing, etc. But all in all, it’s a plain vanilla payment instrument.

A standby letter of credit may have specific clauses that the buyer must fulfill so he can use this instrument. For example, Mr. Harry who resides in the UK agrees to buy 5000 pairs of socks from Mr. Chang who resides in China. Mr. Chang does not want to take the risk so he asks Mr. Harry to get a standby letter of credit. Mr. Harry obtains a standby letter of credit from HSBC bank and he adds the following clauses –

-

The material of the socks should be – 80% cotton 20% polyester

-

Each pair should be packed in a clear plastic bag having a logo tag

-

There can be only 1% defect margin i.e. only one pair of defective socks in a hundred pairs is acceptable

Mr. Chang should fulfill all the above-mentioned performance criteria to be eligible for payment through a standby letter of credit. A regular letter of credit cannot have such performance criteria

The Requirement of Issuing Bank

When issuing a letter of credit the bank checks the buyer’s credibility and credit score. Furthermore, it is usually the case that a buyer asks his banker for a letter of credit, i.e. the buyer is usually dealing with the said bank for a long time. So the letters of credit are usually unsecured.

Conversely, a standby letter of credit creates an obligation for the bank, therefore the bank will require collateral in the form of security to issue a standby letter of credit.

Goal

The letter of credit is a primary instrument of payment, so the goal is to use the letter of credit to complete the transaction.

In contrast, a standby letter of credit is a secondary instrument of payment. If a seller is paid by a standby letter of credit, it means that something went wrong. The goal here for all the parties involved is to avoid using a standby letter of payment.

Time Period

A letter of credit is a short-term instrument, where the expiry is usually 90 days.

A standby letter of credit is a long-term instrument, in which the validity is usually one year or so.

Purpose

A letter of credit is used to provide security for a transaction such as a sale agreement.

A standby letter of credit is often used to provide security for a long-term obligation such as a long-term construction project.

Geographical Scope

A letter of credit is usually used in an international transaction where the buyer is the importer and the seller is the exporter.

A standby letter of credit is used in an international transaction but it is also frequently used in domestic transactions as well. Its scope is not limited to any geographical area.

Cost

A standby letter of credit is more expensive than a regular letter of credit. While the fees of a regular letter of credit range from 0.75% to 1.50% of the amount covered, a bank may charge anywhere between 1% to 10% to cover the same amount under a standby letter of credit which is why it is better to contact Grand City Investment Limited for all your bank instrument transactions such as standby letters of credit and bank guarantees because our bg and sblc fee is just 4% annually. Also, our loan interest rate is 3% per year, so why go elsewhere?

Description of The Standby Letter of Credit (SBLC)

1. Instrument: Fully Cash Backed Standby Letter of Credit (SBLC)

2. Total Face Value: Eur/USD 1Million (Min) to Eur/USD 50 Billion (Max)

3. Issuing Bank: HSBC London/Hong Kong, Barclays Bank London, Citibank New York, Deutsch Bank Germany or any AAA Rated Bank.

4. Age: One Year and One Day (with rolls and extensions where applicable)

5. Leasing Price: 4% of Face Value plus 2% brokers commission (Applicable only if there are brokers in the transaction)

6. Delivery: SWIFT MT-760

7. Payment: MT103 Swift Wire Transfer

8. Hard Copy: Bank Bonded Courier within 7 banking days.

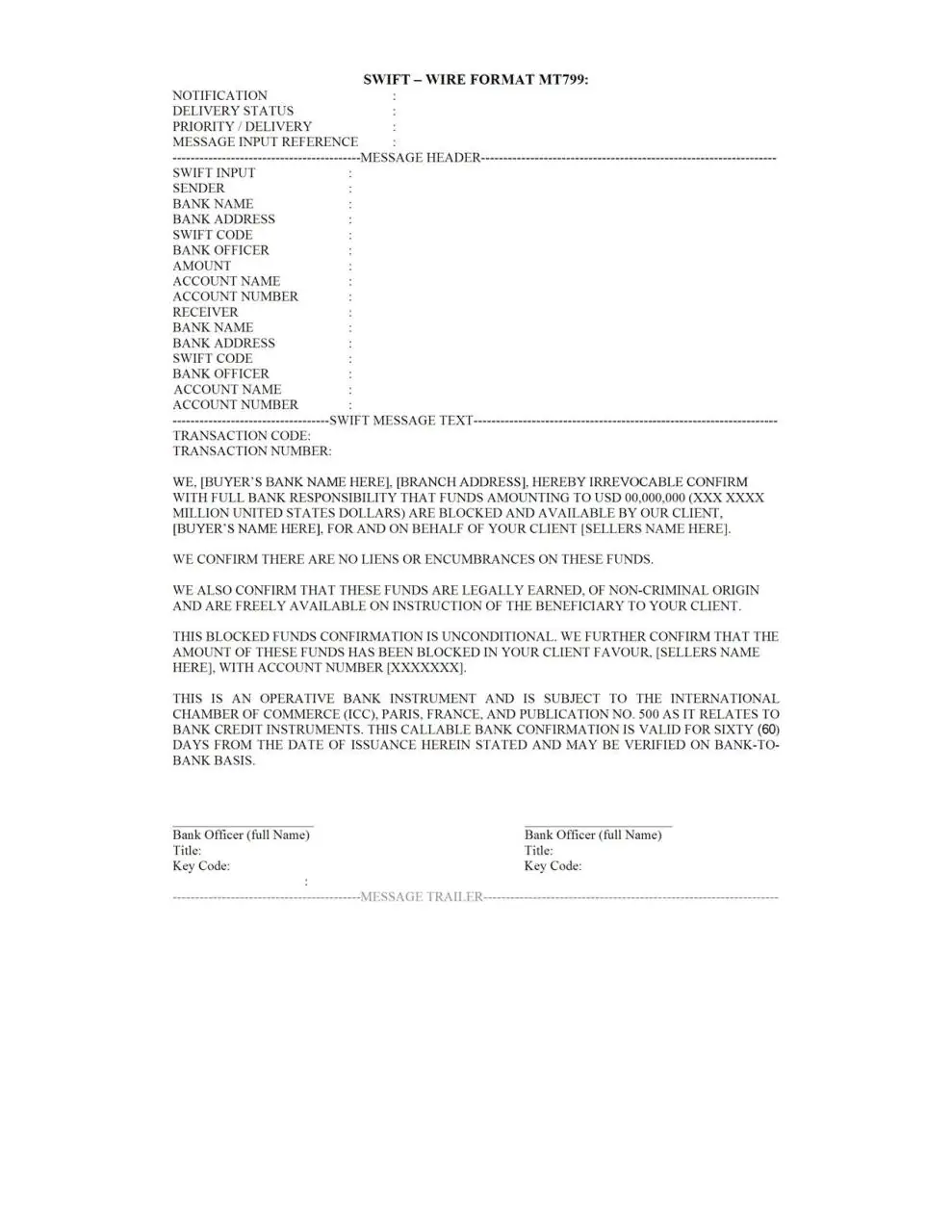

Standby Letter of Credit (SBLC) Sample in Swift Format

Below is a standby letter of credit (SBLC) sample in swift format along with short descriptions of the standby letter of credit.

As already explained, a standby letter of credit is the bank’s undertaking of fulfilling the applicant’s obligations. A standby letter of credit is issued as collateral and is therefore not intended to be used as a primary payment method, unlike a commercial letter of credit. A standby letter of credit will be liquidated only if the applicant defaults of its responsibilities under the underlying contract. As a result, the standby letter of credit serves as a secondary payment option. To conclude this post, I would like to share a standby letter of credit sample in swift format.

Please read our previous article titled “ How To Find Genuine Bank Guarantee (BG) Providers” to understand how to find Genuine SBLC Providers.

I also highly recommend you to read “ Difference Between Swift MT799 And Swift MT760” – “about the different types of bank swift messages that is used in transmitting bank guarantees and standby letters of credit, between banks and other financial institutions” before starting to study the below standby letter of credit swift sample.

AS GENUINE SBLC PROVIDERS, OUR SERVICES INCLUDE BUT NOT LIMITED TO THE FOLLOWING:

Loans: (Personal / Business Loans, Secured / Unsecured Loans, Recourse / Non Recourse Loans etc)

Bank Guarantees: (Performance Guarantee / Tender Bond Guarantee / Advance Payment Guarantee)

Letters of Credit (Red Clause Letters of Credit, Usance LC, SBLC, DLC, L/C etc)

Proof of Funds (POF) Messages: Pre Advice Message / Bank Comfort Letters

Purchase Bank Instruments (Bank Guarantees and Standby Letter of Credit)

Lease Bank Instruments (BG, SBLC, DLC, Letters of Credit)

Wealth Management / Portfolio Management

Insurance & Underwriting Services

PPP and Trading Platforms

Corporate Finance Investments

What drives us? These are the reasons why you should Work With Us: At Grand City Investment Limited we value your time and get straight to the point. Some companies will talk your ear off, we believe that action speaks louder than words so we prefer to be solely focused on results. We have a large network of world-class banks which gives us the unique ability to create outcomes others can’t. We have been in the loan and financial instrument industry since 40 years ago.

When it comes to issuance, leasing, funding and monetization of any bank instrument such as bank guarantee, standby letter of credit, bg sblc, getting to the finish line is all that counts and that’s what we excel in at Grand City Investment Limited. We have been successfully closing deals for over 40 years, show us another company in this industry that can match our record.

Therefore, if you are looking for Lease or Rent Bank Guarantees, bg, dlc sblc, L/C or loans and project funding then you have come to the right place. Kindly contact us today for all your financial needs. NOTICE TO BROKERS/AGENTS/COMPANY REPS: We value and appreciate brokers who are direct to their clients.

New brokers are welcomed and compensated with between 1% to 2% commission on every deal.

Website: www.grandcityinvestment.com

Sorry, the comment form is closed at this time.