02 Oct Difference Between Swift MT799 And Swift MT760

THE DIFFERENCES BETWEEN THE SWIFT MESSAGING TYPES: SWIFT MT799 AND SWIFT MT799 vs MT760

MT799 is a digital message that is sent between banks; with the aim of showing funds or proof of deposits. It is important to note that it is not used as a method of transferring funds or an undertaking to do the same.

MT760 is a message used for issuing or requesting a Letter of Credit or Documentary Credit. Both SWIFT MT799 and SWIFT MT760 are a type of inter-bank message that are used on the SWIFT system so that financial institutions can correspond.

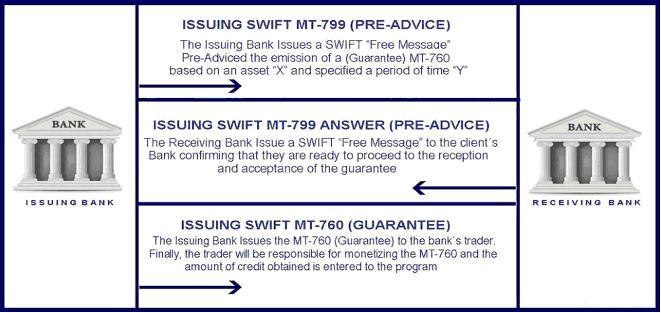

The main difference between the MT760 swift message and the MT799 swift message is in when they are sent. The MT799 is sent before the MT760 and is a prelude to the sending of the MT760. Hence, the role of the MT799 is merely to notify and nothing else. This document is sent days or weeks before the sending of the MT760. It is important to note that the MT799 has no impact on the financial situation of an individual. This is another big difference that exists between the two documents.

The MT760 swift message will impact the financial condition of a client since it a verification of freezing of funds by one bank. The MT799 Swift message will have no impact on the financial situation of an individual since it is sent before the funds are frozen. This is another difference between the two documents. Another difference between the two documents is that the MT760 swift is sent after the sending bank has set aside the required amount of money. The MT799 is sent before the sending bank freezes the required amount of money in the purchasing individual’s bank account.

This is a Swift class 7: Bank Guarantee and Letter of Credit procedure, Procedure 60: Blocked Funds. the course of action when your bank issues MT-760: When an MT-760 is issued, the issuing bank puts a hold on the client’s funds, blocking the client from using them.

A letter of credit is a letter from a bank guaranteeing that a buyer’s payment to a seller will be received on time and for the correct amount. In the event that the buyer is unable to make a payment on the purchase, the bank will be required to cover the full or remaining amount of the purchase.

So in essence, a Letter of credit, also known as Documentary Letter Of Credit, is the bank’s obligation to pay the seller of goods or services a certain amount of money in the timely submission of documents confirming shipment of goods or performance of contractual services.

Documentary letter of credit is one of the most important means of financing in international trade, as the letter of credit is a tool that removes most of the risks as from the buyer (importer) and from the seller (exporter).

SWIFT MT799 and swift MT760

BANK GUARANTEE (BG)

A bank guarantee is a promise from a bank or other lending institution that if a particular borrower defaults on a loan, the bank will cover the loss. Note that a bank guarantee is not the same as a letter of credit. How it works/Example: Let’s assume Company XYZ is a small, relatively unknown restaurant company that would like to purchase €3 million of kitchen equipment. The equipment vendor may require Company XYZ to provide a bank guarantee in order to feel more confident that it will receive payment for the equipment it ships to Company XYZ. To obtain this bank guarantee, Company XYZ requests one from its preferred lender (usually the bank with which it keeps its cash accounts). The lender provides the guarantee in writing, which is then passed on to Company XYZ and its vendor. Company XYZ’s lender essentially becomes a co-signer on the purchase contract with the vendor.

The differences between the letters of credit and bank guarantees

- Letter of credit is opened with the intention of using it, that is, payment by letter of credit is a phenomenon that occurs during the normal course of events (method of payment). Guarantee is used as a way to ensure obligations and is used if in the process of the implementation of one of the parties of the transaction is not able to meet its own obligations.

- Letter of credit is used as a method of payment in one form or another. The guarantee can cover almost any kind of obligations (the advance payment guarantee, performance of contractual obligations, tender obligations, repayment, payment of customs duty, payment of a fine or compensation fixed by the court, the observance of the guarantee period of equipment, guarantee of the payment of court collateral, guarantee of payment of the transfer a football player and many others.) Area of application of guarantee, thus much wider than in credit.

- Letter of credit is a transferable tool, as it allows to optimize the calculations between the partners. Guarantee in rare cases can be transferable as all that is required to receive funding under the guarantee is the requirement of payment, which makes it a ground for abuse of this tool.

Grand City Investment Limited is a Hong Kong based Financial Services Provider that was incorporated on MAY 29, 1984 with Company Registration No. 0137353.

sblc Providers & Bank Instrument Providers - Grand City Investment Ltd

Posted at 04:30h, 01 September[…] MT 760 belongs to a category of SWIFT Message a type of inter-bank message used on SWIFT system to enable financial institutions can correspond. You can read the Difference Between Swift MT799 And Swift MT760 on this post: https://grandcityinvestment.com/difference-between-swift-mt799-and-swift-mt760/ […]

Standby Letter of Credit Provider (SBLC MT760) - Grand City Investment Ltd

Posted at 11:10h, 16 September[…] also highly recommend you to read “ Difference Between Swift MT799 And Swift MT760” – “about the different types of bank swift messages that is used in transmitting bank […]

genuine bank instruments providers - Grand City Investment Ltd

Posted at 10:39h, 07 October[…] recommend you to read “Difference Between Swift MT799 And Swift MT760” – “so you know the different types of bank swift messages that is used in transmitting bank […]

gerçek banka enstrümanları sağlayıcıları - Grand City Investment Ltd

Posted at 13:46h, 07 October[…] Birleşik Devletleri ve Asya’daki diğer uluslararası / çok uluslu Bankalar bulunur. “Swift MT799 ile Swift MT760 Arasındaki Fark” – “bankalar ve diğer finans kurumları arasında banka garantileri ve yedek […]

provedores de instrumentos bancários genuínos - Grand City Investment Ltd

Posted at 14:15h, 07 October[…] internacionais / multinacionais na Europa, Estados Unidos e Ásia. recomendamos que você leia “Diferença entre Swift MT799 e Swift MT760” – “para que você conheça os diferentes tipos de mensagens bancárias rápidas que são […]

gerçek banka garantisi sağlayıcısı - Grand City Investment Ltd

Posted at 07:53h, 10 October[…] artı% 2 komisyoncu komisyonu (Yalnızca işlemde komisyoncular varsa geçerlidir) 6. Teslimat: SWIFT MT-760 7. Ödeme: MT103 Swift Banka Havalesi 8. Basılı Kopya: 7 iş günü içinde Banka Gümrüklü […]

Standby Letter of Credit Definition - Grand City Investment Ltd

Posted at 21:53h, 04 October[…] Click here to read the Difference Between Swift MT799 And Swift MT760 […]