02 Oct BG Bank Guarantee Provider

BG Bank Guarantee Provider-

Who are they?

A BG Bank Guarantee Provider is a bank or lending institution that provides bank guarantees and other bank financial instruments to customers for specific purposes. BG builds confidence between the lender and the borrower. It adds assurance of transaction between an exporter and an importer.

Bank instruments such as bank guarantees and standby letters of credit can be used to obtain loans from banks, they also can be used for trade finance as well as import and export transactions. These financial instruments are used mostly by contractors, importers, and exporters.

Grand City Investment Limited is a genuine bank guarantee Provider that was incorporated in Hong Kong on MAY 29, 1984 with Company Registration No. 0137353 under the Money Lenders Ordinance (Chapter 163 of the laws of Hong Kong).

We are also direct providers of other bank instruments such as standby letters of credit, Trade Finance, Recourse Loan, Non Recourse Loans, Insurance, Investments, Wealth Management, Portfolio Management, Trade Platforms, Private Placement Programs as well as the issuance and monetization of Bank Instruments.

As a registered Money lender in Hong Kong, loans and business funding are available for businesses in all parts of the world such as Asia, Africa, Europe, South America, North America, Australia and the Middle East.

Our loan interest rate is 3% per year, and you can get loan financing from us without security or collateral. The loan duration is up to 20 years with a grace period up to 3 years. The best part of our loan funding arrangement is that we do not charge any prepayment penalty. So customers can repay the loan on time without penalty.

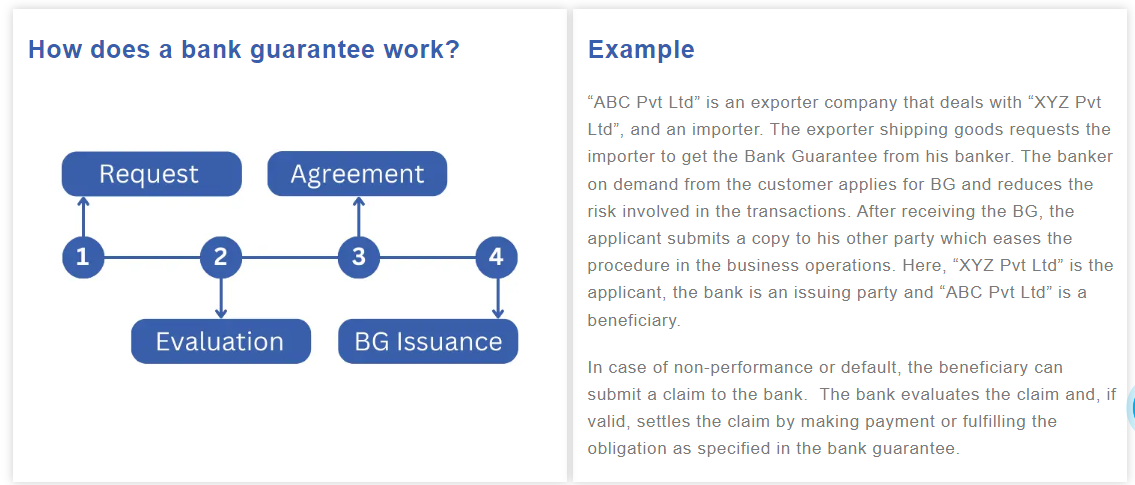

A bank guarantee is a guarantee given by the bank on behalf of the applicant to cover a payment obligation to a third party.

What is a (BG) Bank Guarantee?

A bank guarantee is a promise by a lending institution such as Grand City Investment Limited to cover a loss if a business transaction doesn’t unfold as planned. The buyer receives compensation if a party doesn’t deliver goods or services as agreed or fulfill contractual obligations.

The guarantee is an assurance that the lending institution like Grand City Investment Limited provides to a contract between two external parties, a buyer and a seller, or in relation to the guarantee, an applicant and a beneficiary. The bank guarantee serves as a risk management tool for the beneficiary, as the bank assumes liability for completion of the contract should the buyer default on their debt or obligation.

Bank guarantees serve a key purpose for small businesses; the bank or lending institution, through their due diligence of the applicant, provides credibility to them as a viable business partner for the beneficiary of the guarantee. In essence, the bank puts its seal of approval to the applicant’s creditworthiness, co-signing on behalf of the applicant as it relates to the specific contract the two external parties are undertaking.

Genuine BG Bank Guarantee Provider – Grand City Investment Limited

Types of Bank Guarantees

A bank guarantee is for a specific amount and a predetermined period of time. It clearly states the circumstances under which the guarantee is applicable to the contract. A bank guarantee can be either financial or performance-based in nature.

In a financial bank guarantee, the bank will guarantee that the buyer will repay the debts owed to the seller. Should the buyer fail to do so, the bank will assume the financial burden itself, for a small initial fee, which is charged from the buyer upon issuance of the guarantee.

For a performance-based guarantee, the beneficiary can seek reparations from the bank for non-performance of the obligation as laid out in the contract. Should the counterparty fail to deliver on the services as promised, the beneficiary will claim their resulting losses from non-performance to the guarantor – the bank.

For foreign bank guarantees, such as in international export situations, there may be a fourth party – a correspondent bank that operates in the country of domicile of the beneficiary.

We strongly recommend that you check out our guide on how to spot fake BG/SBLC Provider

Our team of experts is dedicated to guiding clients through every step of the funding process, ensuring their success while maintaining strict confidentiality.

This article was brought to you by Grand City Investment Limited, A Global Financial Services Company. For more information on startup and business funding, or to complete a funding application, please visit our website.

Sorry, the comment form is closed at this time.