23 Jul Bank Guarantee providers in London, Germany, Europe or USA

Do you want to enhance your business and you need bank guarantee providers in London, BG providers in Germany, sblc providers in Europe or hsbc sblc in the USA? Then this article is right for you. As a business owner, if you want to earn more, then you have to buy more goods and sell more. Well, you can buy goods from another country or another unknown party through bank guarantees or sblc mt760.

Read this article to the end. Here you will get a comprehensive knowledge of what a bank guarantee is.

Definition of a bank guarantee in London, Germany, Europe or USA.

Bank Guarantee providers in London, Germany, Europe or USA

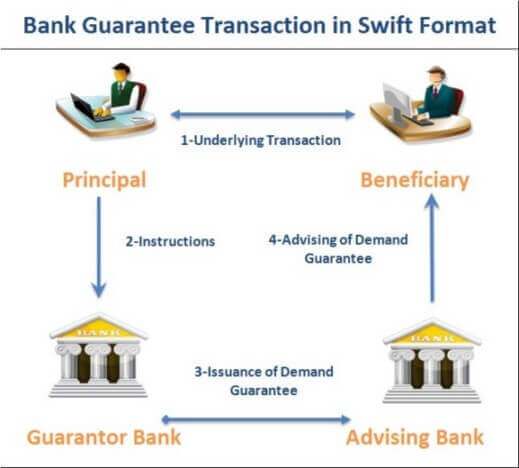

A bank guarantee is an assurance that a bank provides to a contract between two external parties, a buyer and a seller, or in relation to the guarantee, an applicant and a beneficiary. The bank guarantee serves as a risk management tool for the beneficiary, as the bank assumes liability for completion of the contract should the buyer default on their debt or obligation.

So a guarantee is a legal promise. It is an agreement from a bank to cover the responsibilities of a debtor in case of the debtor’s loss to fulfil proper commitments with another company. It is commonly given by the commercial banks to parties engaged in agreements with foreign or unknown parties. But, this system will be valid for a definite period.

There are usually two types of bank guarantees, such as Performance guarantee and financial guarantees. Both are secure processes. Several business-owners take these facilities regarding cash transition.

CLICK HERE TO GET A BANK GUARANTEE FROM TOP AAA RATED BANKS IN THE WORLD.

Advantages

Go through the below mentioned points and you will easily understand the benefits of a bank guarantee.

- If you apply for a bank guarantee, you will need to submit very few documents.

- As a buyer, you are not required to make the advance payment in case of a bank guarantee.

- As a buyer you can increase your industry, you can purchase your goods from other party. Here the bank provides to stand as the guarantor on behalf of a client (buyer) in a transaction.

Example

Suppose, Textile Company ‘XYZ’ wishing to purchase raw material (cloth, thread, elastic, and fibre) and another dealer requires Party B will prepare a bank guarantee to cover payments before transferring the material. Company XYZ would go to its bank and request a guarantee. The bank would represent a credit due alertness and make an order as to the possibility of their even requiring to make good on the guarantee (and if they do, what is the chance they cannot get their pay back from their client). They would use this information to set a cost for the guarantee. The bigger they see the risk as being, the bigger the fee they will require. In high-risk situations, they may require other securities from the company. The bank typically consigns the investment contract between Companies XYZ and the dealer.

How can you get a bank guarantee mt760? As a growing trader, importer or exporter, a bank guarantee or letters of credit from Grand City Investment Limited can help you to close more deals.

Please Read: Standby Letter of Credit, Letter of Credit, Usance LC

Features of a Valid Bank Guarantee

- The period until which the guarantee holds is clearly specified

- The guarantee issuance is always for a specific amount

- The purpose of the guarantee is clearly stated

- The guarantee is valid for a specifically defined period

- The grace period allowed to enforce guarantee rights is also stated in the guarantee

- Guarantee clearly states the events under which it can be enforced

It is important that guarantee can be enforced based on terms of the contract (i.e. guarantee agreement) existing between the bank and the beneficiary. Generally, beneficiaries do state a clause to be included for charging penal interest in the case of delayed payment. Hence, it is essential for the bank to be cautious while finalizing the format and text of the contract (the guarantee agreement). While signing the same, the provision of penal interest and clauses attached to delays and default are to be carefully noted.

Bank Guarantee Process- How To Get A Bank Guarantee (BG)

GRAND CITY INVESTMENT LIMITED is a provider of bank guarantee at 4% leasing fee per year. We are also direct providers of business loans, international project funding, Standby Letter of Credit (SBLC), Letter of Credit (LC/DLC), BG, SBLC, Lease BG etc.

Our bank instruments are cash backed and can be used for Discounting, Monetization and Private Placement Programs (PPP). They also can be used as collateral against a loan or credit line to secure Funding for Projects, as well as import and export transactions because many importers and exporters are always in need of bg bank guarantees as well as contractors, export finance, international trade finance etc.

If you want to learn more about Bank Guarantees in London, USA or Germany please visit this website — https://grandcityinvestment.

No Comments