01 Oct BANK DRAFT (CASH BACKED)

BANK DRAFT (CASH BACKED)

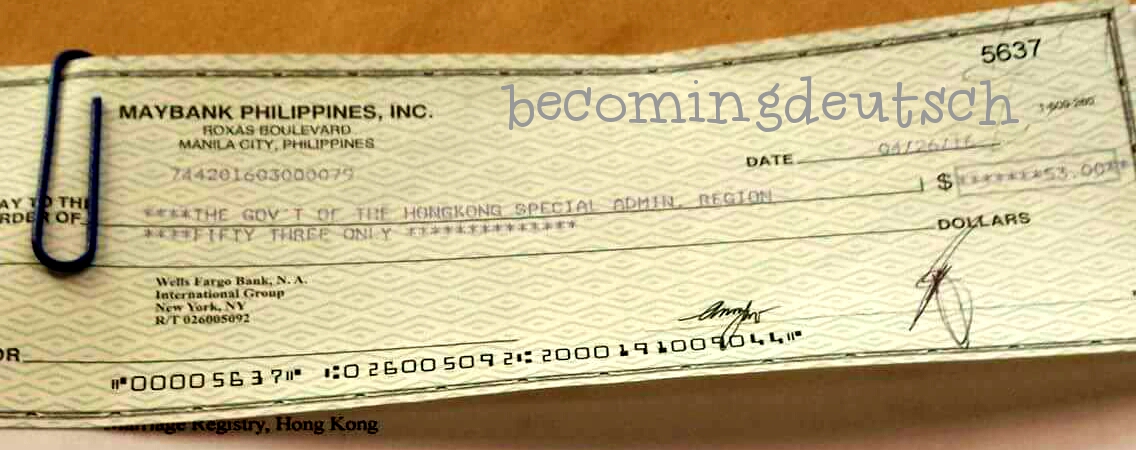

A bank draft is a check drawn on a bank’s funds and is guaranteed by the bank that issues it. A bank draft is safer than a personal check when accepting large payments.

To get a banker’s draft, a bank customer must have funds (or cash) available, and the bank will freeze or keep those funds in the bank’s own account until the payment is completed. Banks are able to guarantee bank drafts because the customer has already “paid.”

The term bank draft is used for other situations, and use varies from country to country. For example, electronic bill payments that move funds directly from a bank account to a service provider (such as an electric utility provider or an online merchant) are also called drafts. A traditional bank draft is a form of payment used when safety is important.

Large amounts: for high currency transactions, the consequences of a returned (or bounced) check would be significant. It’s risky to send expensive goods or complete a deal when there’s any uncertainty about a successful payment. A bank draft is a guaranteed form of payment that makes the payment much more likely to go through.

Available funds: standard checks can take several business days to move through the banking system. Receiving a check doesn’t mean you actually receive funds (and can withdraw the funds).

Bank drafts will generally be available in the recipient’s account within one business day, and it’s unlikely that the bank will reverse the deposit a few days or weeks later. Bank drafts are often used for international trade or purchasing. The term “cashier’s check” is sometimes used instead of bank draft. A cashier’s check is very similar to a bank draft: it’s a check that’s printed and guaranteed by the bank after the bank receives money from the drawer (the person who wants to make a payment).

Contrast with Standard Checks

To understand the features of a bank draft, it’s helpful to compare and contrast with regular personal and business checks. When a person or business writes a check, they don’t necessarily need the money available in their account, they can write a check for whatever they want, and the recipient cannot be sure if the check will bounce or not. Of course, there are consequences for passing bad checks, but it happens. Sometimes honest mistakes are to blame, and nobody’s trying to get away with anything (it’s easy to forget about other transactions that drain an account).

With a bank draft, the funds are moved into the bank’s accounts once the draft is issued. In other words, the person or organization paying with a bank draft can’t even get a bank draft unless they have the funds required, and they can’t spend that money before you deposit the bank draft because the bank already took the money out of their account. Instead of relying on everybody who writes a check, you’re relying on a bank (which presumably has significant assets and strict procedures in place) to back up the payment. If the bank goes out of business, you won’t get paid, but that risk is fairly small.

Are Bank Draft Payments Safe?

If somebody pays you with a bank draft, you can’t always assume you’ll get the money. You may believe you’re getting paid with cleared funds, but you should always check with your bank and verify that the check is legitimate before you spend the money or sell something valuable.

You can even go a step further and verify funds with the issuing bank before handing over merchandise or depositing a bank draft. To deposit or cash a bank draft, treat it as if it was any other check. Take it to your bank and endorse the back of the document. Your bank will credit the funds to your account more quickly if you make your deposit with a bank employee, and you might be able to get more (or all) of the amount in cash immediately.

BANK DRAFT OFFER

DESCRIPTION OF INSTRUMENT:

Instrument Type: Bank Draft (BD) Cash-Backed

Issuing Bank: DEUTSCHE BANK, HSBC, BARCLAYS BANK, RBS

Minimum/Tr: €10 Million (Ten Million Euros)

Maximum/Tr: €500 Million (Five hundred Million Euros)

Price: XX% (X%) Percent of BD Face Value

Commission: Two (2%) Percent of BD Face Value

Currency: European Union Currency (€)Payment: MT103 wire transfer

Delivery: Hard copies will be delivered by bonded courier

TRANSACTION PROCEDURE:

- Buyer submits duly sealed and signed LETTER OF INTENT/DEED OF AGREEMENT (LOI/DOA) on Buyer’s Letterhead with full Banking Coordinate along with below compliance documents: Accepted Verbiage for MT110, Corporate Payment Guarantee (CPG), Non-Solicitation Statement (NS), Client Information Sheet (CIS), Corporate Resolution (CR), Irrevocable Master Fee Protection Agreement (IMFPA), Buyer Signatory and Color Copy of Passport, Buyer Certificate of Incorporation (COI)

- Upon receipt of the sealed, signed, LOI/DOA and compliance document from Receiver, Provider will counter sign and return it to Buyer in PDF at which time the LOI/DOA becomes a formal and legal binding document between the two principals.

- Provider issues bank draft and forward scanned copy to buyer for verification

- Upon verification, the receiver gives Payment Guarantee (PG)

- Upon the Provider’s receipt of the PG, the Provider will send MT110 to the receiver’s bank.

- Within five (5) bank working days upon the receipt, confirmation of Provider’s Swift MT110 Confirmation by Receiver’s Bank Account Officer, Receiver shall instruct his bank to pay by Swift MT103 wire transfer the xx% (…………. PERCENT) Instrument’s Invoice Price to the Provider and simultaneously pay 2% (TWO PERCENT) commission to the brokers according to the Irrevocable Master Fee Protection Agreement.

- After seven (7) days upon receipt of full payment of the xx%+2% cost of the Bank Draft MT110 Instrument, Provider send Original Copies of the “Bank Draft”, “Bank Sealed and Signed Swift MT110” and “Confirmation Letter” directly to receiving bank by bank bonded courier.

———— Contact us for the detailed Terms and Price ————–

No Comments