29 Oct Standby Letter of Credit Definition, Issuance and Notification

The Standby Letter of Credit – Definition, Issuance and Notification

Another prominent payment technique used in international trade is the Standby Letter of Credit. What is a Standby Letter of Credit (SBLC)? How is it different from a Letter of Credit? How do issuance and notification of a Standby Letter of Credit work? … This article provides the answers to these questions.

We already know what a Letter of Credit is. It is another naming for the documentary credit that was analyzed in the preceding articles. The key to understand this payment technique is therefore the word Standby. In the Cambridge dictionary, it reads about that word:

- Something that is always ready for use, especially if a regular one fails.

- When a person or a thing is on standby, they are ready to be used if necessary

A Standby Letter of Credit is therefore a Letter of Credit that is ready to be used if required. Now let’s consider its definition.

What is a Standby Letter of Credit (SBLC)?

The Standby Letter of Credit (SBLC) is a guarantee issued by the importer’s bank, in favor of the exporter, for an amount agreed at the signing of the commercial contract. It provides a guarantee to the exporter that, if due to any circumstances, the importer is unable to pay, then the bank will make the payment.

The Standby Letter of Credit is used as an insurance against the risk of non-payment. It is intended for preventing contracts from going unfulfilled in case the importer declares bankruptcy or is unable to pay for goods or services provided. Like an insurance, a Standby Letter of Credit is not put into play when everything goes well. However when a bank issues a SBLC on the request of a business, it proves that business’ credit quality and repayment abilities to some extent.

The Standby Letter of Credit was created in the United States to circumvent US banking legislation that prohibits banks from issuing guarantees and surety bonds. Only insurance companies or similar companies are legally allowed to issue them in the USA. The US banking system has circumvented this prohibition by issuing guarantees requiring the submission of certain documents to make them work.

There are two types of Standby Letters of Credit: Performance SBLC and Financial SBLC.

-

A Performance Standby Letter of Credit is issued to ensure that nonfinancial contractual obligations are performed in a timely and satisfactory manner. These obligations can be related to quality of work, amount of work, delivery time, asn. In case they are not met, the bank will pay the beneficiary in full.

-

A Financial Standby Letter of Credit, on the other hand, is issued to ensure that financial contractual obligations are fulfilled. That means the importer pays on time provided he has received all the goods and/or services from the exporter, the beneficiary of the SBLC. But a Financial SBLC can also be in favor of the exporter’s bank. Standby Letters of Credit are financial most of the time.

The standby letter of credit is often preferred over a documentary credit because it presents some advantages for both parties:

- The administrative formality is simple and not very constraining

- It allows fast and direct shipping of documents to the buyer without going through the banks

- It is adapted to all incoterms including those of the D group related to the deliveries. We will get back to Incoterms in the future.

- If it is not enforced, its cost is less than that of a Documentar Credit

- It can come to fruition in a few hours

-

etc.

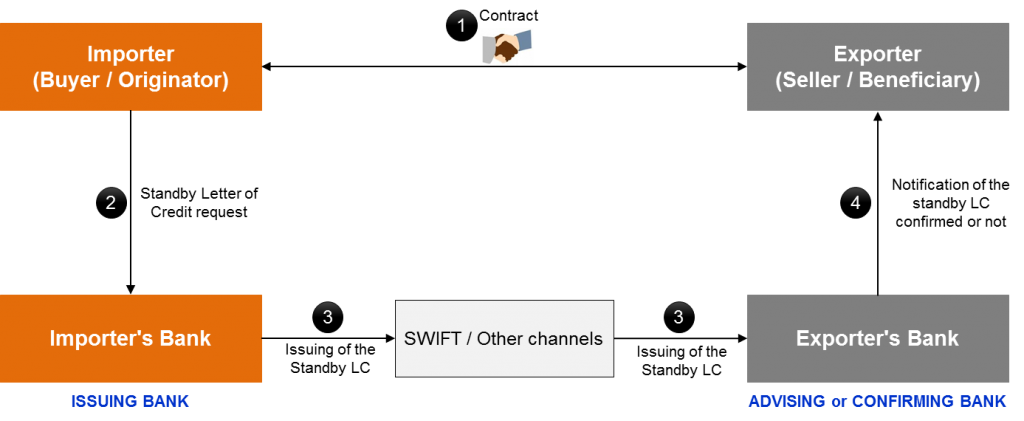

We will now consider how the issuance and notification of the standby letter of credit work. The diagram below shows the steps involved in issuing and notifying a Standby Letter of Credit. The parties involved in a SBLC are the same as the ones involved in a documentary credit. I am sure you recognize the Four Corner Model :-), our main tool to analyze payments instruments and techniques.

Standby Letter of Credit, Standby Letter of Credit provider, Standby Letter of Credit meaning, Standby Letter of Credit types

Issuing and Notification of a Standby Letter of Credit

We consider each step in the following:

1. The signature of the contract between the exporter and the importer

This step is very important for the success of the whole operation. The two parties agree the terms of the transaction in a contract: the goods, transport and shipping arrangements, delivery times, documents to be provided by the buyer, the payment guarantee (In this case the standby letter of credit), the payment instrument, what to do in case of dispute (Non payment, problems on the goods, etc.)..

Companies are strongly advised to seek the support of international trade professionals to avoid mistakes. Even if forms exist, it is not always easy to fill them out and the omission of an important point can put the whole operation in question.

Furthermore, it is also strongly recommended for both parties to get in touch with their banks during this phase and not after signing the contract. Banks have experience in international trade and can provide valuable advice for the smooth execution of the transaction in legal, logistical and financial terms.

2. The standby letter of credit request

The importer asks his bank to open a standby letter of credit in favor of the exporter. He hands out a letter of order to the bank where he precisely states the terms of the SBLC. It must, among other things, list the documents to be submitted by the exporter in the event of the SBLC being brought into play. The bank is very strict with the formalism of the demand. If the SBLC can refer to the contract between importer and exporter, it is important to note that under no circumstances is the bank bound by the terms of the contract.

After getting the request, the bank carries out a thourough examination of his client situation. The bank may consider that the risk is too high and reject the request if it thinks that its client will not be able to pay in case the SBLC is put into play. Sometimes the bank may require his client to block some or all of the funds or to provide collateral in other forms. If the request is accepted, the bank informs the client by mail or other means.

3. The issuance of the standby letter of credit

The importer’s bank issues the standby letter of credit in accordance with the request received from his client. The issuance of a SBLC is usually done by transmission of a SWIFT MT 700 message if both banks are connected to the SWIFT networks. Otherwise, it is done by encrypted telex or by mailing a standardized form of the International Chamber of Commerce previously filled in. The sending of the MT 700 is the preferred solution because of the security and speed offered by the SWIFT network.

4. Notification of the standby letter of credit confirmed or not

The correspondent of the importer’s bank after getting the SBLC may add its confirmation, that is to say commit, as the issuing bank, to make the payment under the conditions defined in the SBLC. To keep things simple, we consider that the exporter’s bank is the correspondent of the importer’s bank. But it’s not always the case.

In any case (confirmation of the SBLC or not), the correspondent notifies the exporter that a standby letter of credit is opened in his favor. He transmits the original in paper format.

As stated above, the SBLC is not intended to be used if everything works as expected. It can happen though, that the payer is unable to fulfill his obligations. In that case, what does the beneficiary do? In the next article, we will see how a standby letter of credit is brought into play.

StandBy Letter of Credit {SBLC} Description

1. Instrument: Cash Backed StandBy Letter of Credit {SBLC}

2. Total Face Value: Eur/USD 1Million (Min) to Eur/USD 5 Billion (Max)

3. Issuing Bank: HSBC London/Hong Kong, Barclays Bank London, Citibank New York, Deutsch Bank Germany or any AAA Rated Bank.

4. Age: One Year and One Day (with rolls and extensions where applicable)

5. Leasing Price: 4% of Face Value plus 2% brokers commission (Applicable only if there are brokers in the transaction)

6. Delivery: SWIFT MT-760

7. Payment: MT103 Swift Wire Transfer

8. Hard Copy: Bank Bonded Courier within 7 banking days.

SAMPLE SWIFT MT-760 FROM ISSUING BANK TO RECEIVER BANK

(Text may vary in substance but the essential undertaking must be maintained)

FROM

BANK NAME:

BANK ADDRESS:

BANK TEL:

BANK FAX:

BANK OFFICER NAME:

SWIFT CODE:

ACCOUNT NAME:

ACCOUNT NO:

TO

BANK NAME:

BANK ADDRESS:

BANK TEL / FAX:

BANK OFFICER NAME:

SWIFT CODE:

ACCOUNT NAME:

ACCOUNT NO:

TRANSACTION CODE:

BG/SBLC NO:

CURRENCY:

AMOUNT:

ISSUING DATE:

MATURITY DATE:

FOR THE VALUE RECEIVED, WE NAME & ADDRESS OF BG /SBLC

ISSUING BANK&XX. HEREBY IRREVOCABLY AND UNCONDITIONALLY,

WITHOUT PROTEST OR NOTIFICATION PROMISE AND GUARANTEE TO

PAY ON TIME, IN FULL AND WITHOUT DELAY, AGAINST THIS BG/SBLC IN

FAVOUR OF XXCLIENT'S NAMEXXX, THE BEARER OR HOLDER THEREOF,

AT MATURITY THE OF 00,000,000.00 (AMOUNT IN WORD) IN THE LAWFUL

CURRENCY OF XXX THE UNITED STATES OF AMERICA OR EUROPEAN

UNION XXX.

SUCH PAYMENT WILL BE UPON PRESENTATION AND SURRENDER OF

THIS BG/SBLC AT THE OFFICE OF XX&;NAME OF BG/SBLC ISSUING

BANK&;XX WITHOUT SETOFF AND FREE AND CLEAR OF ANY

DEDUCTIONS, CHARGES, FEE OR WITHHOLDING OF ANY NATURE NOW

OR HEREAFTER IMPOSED, LEVIED, COLLECTED, WITHHELD OR

ASSESSED BY THE GOVERNMENT OF THE ISSUING OR PAYING BANK OR

ANY POLITICAL SUBDIVISION OR AUTHORITY THEREOF OR THEREIN.

THIS BG/SBLC SHALL BE GOVERNED AND BE CONSTRUED IN

ACCORDANCE WITH THE UNIFORM RULES FOR DEMAND GUARANTEE

(URDG), AS SET FORTH BY THE INTERNATIONAL CHAMBER OF

COMMERCE, PARIS, FRANCE ICC PUBLICATION #600.

THIS BG/SBLC IS TRANSFERABLE, ASSIGNABLE AND DIVISIBLE WITHOUT

PRESENTATION TO US.

FOR AND ON BEHALF OF:

XXX ISSUING BANK XXX

XXX ISSUING BANK ADDRESS XXX

BANK OFFICER

1 BANK

OFFICER 2

TITLE

(PIN)

TITLE (PIN)

Our bank instrument can be engaged in PPP Trading, Trade Finance, Import & Export Transactions, Discounting and Monetization, signature project (s) such as Aviation, Agriculture, Petroleum, Telecommunication, construction of Dams, Bridges, Real Estate and all kinds of projects.

As leading sblc providers, we deliver with time and precision as set forth in the deed of agreement (DOA). Our bank guarantee and Standby Letters of Credit terms and Conditions are reasonable, below is our instrument description.

Once the transaction is in progress, we ensure we keep you posted on the progress of your paper. Instead of stressing yourself out looking for a financial instrument or company why not let professionals like us deliver financial instruments to you within the time frame required by you.

OUR SERVICES ARE:

Loans: (Non Recourse Loans, Business Loans, Secured Loans, Unsecured Loans, International Project Financing)

Purchase Bank Instruments (Bank Guarantees and Standby Letter of Credit)

Lease Bank Instruments (BG, SBLC, DLC, Letters of Credit)

Letters of Credit (DLC, L/C, Usance LC)

Investments and Wealth Management

Insurance Underwriting Services

PPP and Trading Platforms

Corporate Finance

BROKER INQUIRIES ARE WELCOMED AND APPRECIATED: Our brokers receive 2% commission for referral. Daisy Chains of Brokers, Scammers & Time Wasters Will Not Be Entertained. We assist Clients and brokers in their attempt to secure funding by working on their funding requests that may require innovative financing.

We would welcome the chance to earn your trust and deliver you the best financial service in the industry. Have a look at our portfolio here: https://

Contact us today to know how a Leased Standby Letter of Credit mt760 from barclays bank, hsbc bank, Chase Bank, Standard Chartered Bank or Bank of America can help you conclude worthy deals with your suppliers and contractors.

Can You Monetize Bank Instruments such as SBLC or BG? - Grand City Investment Ltd

Posted at 02:23h, 05 October[…] A Standby Letter of Credit (SBLC) is used as a payment guarantee. For example, if a buyer in the USA secures a contract for […]