04 Oct How Long Does It Take To Close On A House?

Did you know the average homebuyer took 73 days to close on a home after the first visit? That is true according to a data-driven study by Redfin.

If you’re a buyer or seller in the real estate business, you might be asking the question, ‘How long does it take to close on a house?’ Well, you’ve come to the right place.

Closing on a house can be a daunting and intimidating process if you don’t know what to expect.

Fortunately, after reading this guide the home closing process will be predictable and repetitive for you.

We dive into everything from the amount of time it takes to close on a house to a step-by-step guide on what it means to close on a property.

Let’s dive right in! We hope you enjoy How Long Does It Take To Close On A House!

What Does Closing On A House Mean?

Closing on a house, also referred to as settlement or completion, means that both parties to a real estate transaction have fulfilled their obligations as outlined in a purchase and sale agreement, resulting in a transfer of ownership from the seller to the buyer of a property.

At this final stage in the transaction, a number of things take place in a short amount of time. A title or escrow company is engaged to facilitate the closing process. Primarily, the deed is recorded, and funds are transferred from the buyer to the seller of the property.

It’s an exciting time when both sides finally come together – having worked through days, weeks, often months of uncertainty and due diligence to get to this point…

Closing on a house usually involves the following parties:

- Buyer, purchaser, or offeror of real estate

- Seller, property owner, or offeree of the property

- Real Estate Agent

- Buyer’s Broker and Agent

- Seller’s Broker and Agent

- Title Company or Attorneys

- Escrow Company

- Mortgage Lender

- Loan Officers

- Notary Public

The closing process starts at the initial contract signing and can be drawn out much longer than intended. Closing on a home can be subject to delays, contingencies, along with many other variables that can sour a deal and cause it to go south.

In the next section, we’ll cover the steps to close on a house.

“The best time to buy real estate was 5 years ago, the next best time to buy is today.” -Anonymous

What Are The Steps To Close On A House?

Here’s a playbook that includes the steps to close on a residential house:

Secure Funding

For most buyers, this means getting pre-approved for a home loan by a mortgage lender. You can expect to fill out a lengthy application, run a credit report, check your credit scores, discuss mortgage rates, provide income statements, paycheck stubs and other financial information.

Popular lenders include:

- Chase

- Bank of America

- Wells Fargo

The results of the pre-qualification stage of the mortgage process will determine how much purchasing power you have. The size of loan you qualify for will ultimately dictate the price range of house you’ll be shopping in.

Additionally, make sure you have enough liquid funds available for the down payment and closing costs of your home purchase.

Alternatively, you may choose to close on a house entirely with your own cash, borrow private money, or other financing.

Find A House

Once you’ve secured your funding source, it’s time to house hunt!

Connect with several real estate brokers in the area you’re looking to buy to help you locate your ideal house. You can also look at home listing sites like Zillow, Realtor.com, Trulia and Redfin.com to find houses on your own.

Check out at least 5 homes and attend multiple open houses before making an offer. This way, you’ll get a feel for property values in an area.

Make An Offer

Once you’ve identified a house that fits the bill, make an offer! Here’s where a great real estate agent can help out tremendously.

Buyers should expect to make multiple offers before getting one accepted. Here’s a short video that discusses what happens after an offer is accepted:

Open Escrow

When your offer is accepted by the seller, you open escrow on the property. This entails choosing an escrow agent and title company, submitting your earnest money deposit to a trust fund account, reviewing property disclosures, locking in mortgage rates, completing your loan process, and moving forward with the closing process.

Compared to other parties in the transaction, mortgage lenders require the longest amount of time to close on a house and are often the source of delays in closing on a home.

Home Inspection

While they are optional, most buyers will perform a professional home inspection before they close on a house. This is a good idea in case you discover any damages, repairs needed, or other factors that materially affect the value of the home. Depending on the results of your home inspection, the initial offer you made to purchase the home may need to be adjusted.

Appraisal

Nearly all lenders will require an appraisal of the home. An appraisal is when a third-party licensed valuation professional prepares a report that suggest the market value of the property in its present condition.

The lender will make a loan based on a percentage of the appraised value – also know as the loan to value ratio.

Remove Contingencies

Your contract may include a number of contingencies, which allow you to terminate the agreement if certain conditions are not met to your satisfaction. These contingencies may include: home inspection, appraisal, mortgage loan, insurance, and clear title.

If any of these conditions are not met, you can walk away with your earnest money deposit refunded. Assuming you are satisfied with the results of your due diligence, you may remove your contingencies and proceed to closing on the home.

Close On A Home!

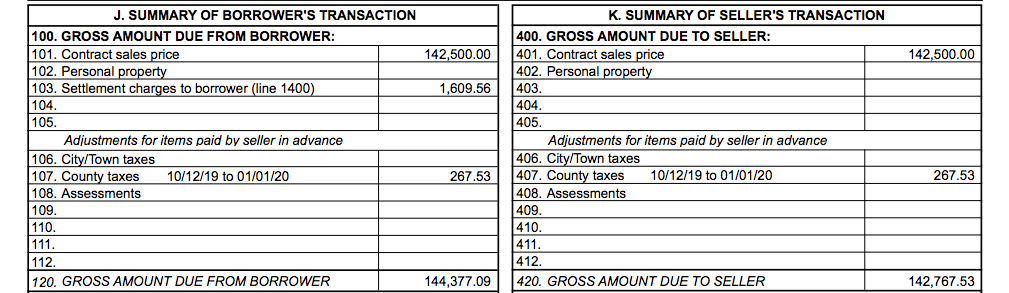

Once you’ve satisfied your due diligence and removed all contingencies – you’re ready to close on a home! Review and sign every disclosure, promissory note, settlement statement, and other paperwork to seal the deal.

A closing disclosure or HUD-1 Settlement Statement is often used as a primary closing document to represent the transaction. Here’s an image of a portion of the HUD-1:

Once you sign and approve, transfer your purchase funds to the title company and you’ll soon receive the keys to your new property! Congrats, you’ve now completed your home purchase.

How Long Does It Take To Close On A House With A Conventional Loan?

One of the most widely available options for home buyers is using a conventional loan to fund the purchase. Conventional loans traditionally require at least a 20% down payment, though there are now programs that allow only 3% down.

Conventional lenders generally need at least 30 to 45 days to close on a house. Big banks, such as Chase, Bank of America, and Wells Fargo are notorious for taking more time to close home loans than smaller, local banks, lenders, and credit unions.

That said, of all the financing options you have to close on a house, a conventional loan might be the most popular among all the products available. The length of time it takes to close with a house largely hinges on the ability of the lender to get the deal done in an efficient manner.

The best way to make sure the closing process moves as quickly as possible when using a conventional loan is for the buyer to have all their ducks in a row before going into escrow.

This means getting pre-approved by the lender of choice, having all required documents on hand, and being readily available throughout the process to answer questions and promptly provide the lender with any information they need.

How Long Does It Take To Close On A House With A VA Loan?

Closing on a home with a VA Loan requires additional steps which can cause the closings to take longer than a conventional loan closing. VA loans generally take around 40-50 days to close.

The additional steps include obtaining a Certificate of Eligibility (COE) to make sure you are qualified to receive the loan. Also, a VA appraisal is ordered to ensure the house meets the VA’s Minimum Property Requirements. The VA appraisal ensures the house is a safe, habitable, and structurally sound investment, but can take up to 10 days to complete.

VA Home Loans are guaranteed by the U.S. Department of Veterans Affairs (VA), though they are funded by private banks and mortgage lenders. VA loans are reserved for members of the Selected Reserve, active duty service personnel, veterans, and even certain categories of spouses.

Although it takes longer to close on a home with a VA loan, many believe it’s worth the extra hassle because you can buy a home with 0% down and secure below-market interest rates!

Here’s a video from Bank of America covering how VA home loans work:

In summary, the steps to obtain a VA Loan are as follows:

- Connect with a VA-Approved Mortgage Lender

- Secure a Certificate of Eligibility (COE)

- Get Pre-Approved with the VA Lender

- Find A House and Open Escrow

- Complete The Lender Application and

- Lender Orders a VA Appraisal

- Close on The Home With A VA Loan

How Long Does It Take To Close On A House After Appraisal?

After an appraisal is completed, it usually takes at least another 1 to 2 weeks to close on a home. When the appraisal is submitted to the loan officer, it takes some time for the lender to process the appraisal, make adjustments to the loan if needed, and satisfy any remaining conditions in order to get the mortgage approved.

If the property doesn’t appraise for at least the contracted sales price, there may be delays in closing on the home. Since the lender will only lend money up to a certain percentage of the property value (see: loan to value ratio), the parties of the transaction must decide who makes up the difference.

Several options exist at this point.

- The seller reduces the sales price to match the appraised value.

- The seller offer closing credit to the buyer.

- The buyer brings additional money to closing in excess of the downpayment.

- A combination of the above options.

It may take a few extra days to determine the path forward, which may involve several rounds of negotiations.

The purpose of the appraisal is to determine the current market value of the property that is being used as collateral for the mortgage loan. Most lenders require this because they want to make sure the underlying security behind the loan is worth more than the amount of the loan.

In case the borrower defaults on the loan, the lender can take back or foreclose on the property. The appraisal ensures the lender that they can sell the house and recoup their investment in the mortgage loan without taking a loss.

You can see how offers that are not contingent on appraisals simplify the process of closing on a home.

How Long Does It Take To Close On A House If You Pay Cash?

If you pay cash to close on a house, it can take as little as a few days to complete the transaction. If you’re willing to waive your right to an inspection, appraisal, financing contingencies, or any other agreements that make your commitment to the transaction conditional, you can simply sign closing documents, wire money to the title company, and transfer ownership.

Alternatively, you can complete all of your due diligence before entering a binding contract to purchase the property. The downside of going this route is that you could potentially miss out on the deal if another buyer enters a purchase agreement with the seller while you’re doing your homework.

The truth is that if you pay cash to close on a house, you can close as quickly as needed for the transaction. However, most buyers will offer with contingencies and a timeline that provides adequate time to complete their inspections and due diligence.

Cash home buyers often market their ability to close quickly, which usually ends up being around 1-2 weeks.

How Long Does It Take To Close On A House After An Offer Is Accepted?

The length of time it takes to close on a house after an offer is accepted entirely depends on what is stated in the completed purchase and sale agreement.

A designated close of escrow date is agreed on, which usually hinges on the type of capital the buyer is bringing to the closing table.

Buyer’s closing with VA, FHA, and Conventional loans will generally take 30-60 days to close on a house after an offer is accepted.

If a buyer is funding the deal with cash or using alternative financing such as private or hard money, then it can take as little as one week to close on a house after an offer is accepted.

The actions that consume the most time after an offer is accepted are getting mortgage loans closed, property inspections, title examination, and home appraisals.

How Long Does It Take To Close On A House And Move In?

Generally, the time it takes to close on a house and move in can range from as little as a week to several months – it is ultimately determined by the circumstances of the buyer and cooperation of the seller.

If a buyer is on a tight timeline and needs to move in quickly, the ideal situation is a quick escrow period of less than 30 days, while purchasing a vacant or furnished house.

Purchasing a vacant house means that the seller has completely moved out of the property prior to closing, so the buyer may take possession immediately. This ensures no delay after closing and the buyer is able to move in promptly.

In some circumstances, the seller may need to live in the property for a period of time after closing. While this may work in some instances, be cautious of the liability issues and potential delays with purchasing an essentially “tenanted” property, as the seller may have rights as a tenant.

This is why requesting a house to be delivered vacant is preferred for buyers looking to move in quickly.

Buyers looking to move in quickly should consider purchasing a house that is furnished, or negotiating the sale of the owner’s furniture along with the house. This way, buyers can eliminate the time in between taking possession and being able to comfortably reside in the home. Nobody likes sleeping on the floor, right?

Can You Close On A House In 2 Weeks?

Yes, you can definitely close on a house in 2 weeks or less. However, there are only a few options if you’re serious about a quick 2-week timeline.

Your best options are funding the house with cash, hard money, private money, seller financing, or another form of capital lined up.

If you want to close with financing from a conventional mortgage lender, VA lender, FHA loan, then you won’t likely be able to close on a house in 2 weeks. The only way to do so is to get the mortgage process moving forward ahead of time before putting the property under contract.

Why Does It Take So Long To Close On A House?

lease sblc providers, genuine sblc provider, top sblc provider, leasing sblc, Real SBLC Providers worldwide, real estate loan, real estate loan lenders, real estate loan companies, commercial real estate loan,

You might be wondering why it takes so long to close on a house. Buying a home is a very emotional process for most people and feelings can change from day to day.

For many people, closing on a home is the largest financial decision they make in their entire lifetime! The right amount of time it takes to close on a house may vary from situation to situation. It is prudent to take care by proceeding slowly and diligently considering it’s a large transaction that has long term effects.

There are many variables which delay the closing of homes, which can come from either the buying or selling side of the deal.

Most delays result from customary procedures that are generally beneficial to all sides of the transaction. These include the home inspection, home loan approval, working with the escrow and title company, checking title reports, and reviewing settlement disclosure documents.

Further, it’s important to remember that many sellers live in the property that they’re selling. So, it may take time for the seller to buy a replacement property and move out of their current residence.

Buyers who can best accommodate the seller’s situation with flexible offer terms have a better chance of getting the home!

How Can I Speed Up Closing On A House?

As a seller, you can complete certain time-consuming tasks ahead of time, such as order a home inspection, preliminary title report, and general contractor bids for any major repairs needed.

To speed it up even further, the property owner should resolve all liens, pay off debts, and complete any repairs before marketing it for sale.

As a buyer, to speed up closing on a house you can close with all cash and waive all of your offer contingencies. Acting more prudently, you should keep your contingencies but minimize their expiration dates to remain competitive.

Agreeing to close early on the purchase agreement will ultimately speed up closing on a house. This is referred to as offering with a short escrow period.

How Long After Closing Is The Seller Paid?

The great thing about selling a property is that you can get paid on the same day! Simply collect your check from the title company or have it wired directly to your bank account.

In most real estate transactions, the seller is paid within a day or two from the property officially closing. This means money hitting the seller’s bank account!

In some creative financing scenarios (mostly used by experienced real estate investors), the seller may get paid over time. This is called seller financing when the seller offers to finance the purchase for the buyer instead of a bank.

So instead of receiving a lump sum immediately after selling the property, the seller receives periodic payments from the buyer over a predetermined term.

No Comments